The password will be invalid if client enters the wrong password more than 5 times when logging in the online trading system. You have to reset password to log in the account.

You may click “Forgot Password” on either online trading system in Victory Securities’ website or mobile app and verify your identity by entering your account number at Victory and registered email. A new password will be sent to your email then.

You may also contact our customer service department at +852 2525 2437 or +86 147 1501 7408 for assistance.

- Please download the「Change of Account Information Form」via our website. Clients should fill and sign on the form and send us by mail, email, fax or WhatsApp (5498 9438).

- Also, clients with E-trade service can also update your personal information via our website. Please click here and login in your personal account and password via web trading and submit the application.

*Note: If you would like to change your address, please provide the address proof within latest 3 months as well.

Clients with registered email will activate the E-statement service automatically. When the electronic statements are available to be downloaded by clients, you will receive a notification email. Please click here to login in your account to check your E-statement.

Please note daily combined statements are available to be downloaded within 3 months after its initial issuance date and monthly statements are available to be downloaded with 2 years after its month of issuance.

You can download the statement. An additional statement fee will be charged if the clients with E-statement service require hardcopy of the daily and monthly statements.

Yes, you can choose to receive the hardcopy of daily and monthly statement by mail.

Staring from 1st Jan 2019, we will charge administration fee of HK$20/month for daily and monthly statement by mail. The relevant fee will be automatic deducted from the account on the last trade day of the relevant month and is not refundable.

*Note: the statement fee will be waived for clients who are over 60 years old.

FATCA is a US-made tax law that went into effect in 2014.

FATCA is designed to prevent US taxpayers from using offshore financial accounts to avoid complying with US tax obligations. Victory Securities Limited Company is legally responsible for identifying its clients and reporting their information to the IRS.

In support of the principle of reciprocity, governments around the world are introducing new data collection and reporting requirements for financial institutions, known as CRS. If it is assessed that you are obligated to pay taxes in Hong Kong, Victory Securities, as a licensed financial institution, is responsible for reporting your account information to the Hong Kong Inland Revenue Department.

***These data will be transmitted to tax authorities in other countries or regions.

No. The "Common Reporting Standard" standard has been incorporated into Hong Kong's Inland Revenue Ordinance.

Victory Securities has the legal responsibility to set up and use appropriate programs to collect the specified data, and then send it to the Hong Kong Inland Revenue Department. Don't worry if you have already declared all tax liabilities.

The Inland Revenue (Amendment) (No. 3) Ordinance 2016 (the "Amendment Ordinance") establishes the legal framework for Hong Kong to implement the new international standard for the automatic exchange of financial account data ("AEOI").

The first automatic data exchange was done in 2018. For details, please refer to the website of the Hong Kong Inland Revenue Department. Click here for details.

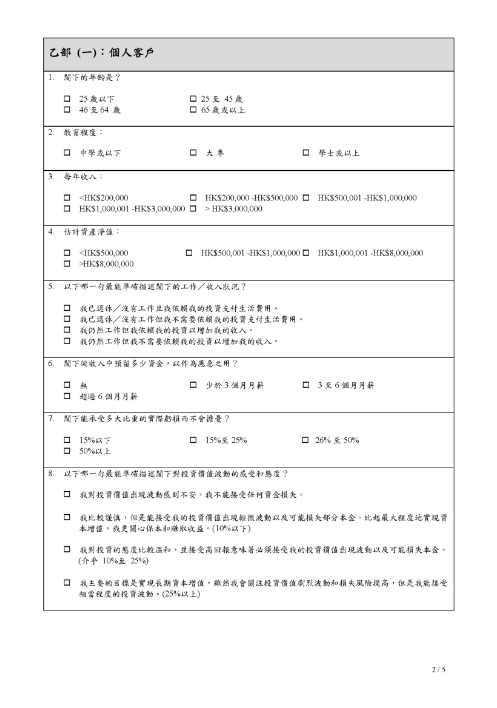

The result of the customer's risk tolerance evaluation is comprehensively determined by the scores of the two parts of investment ability and investment willingness.

Victory Securities will classify investor’s risk tolerance level into three types: high, medium, and low based on the scores in investor’s risk tolerance assessment results.

To open an account online please click the below link

Click HerePlease confirm that the bank card is in your name, the bank card number and the bank name are entered correctly, and the card should be a debit card.

The identity document used in bank account opening must the same as the identity document used on the previous page.

You can switch the debit card of other banks for verification. Debit cards of Bank of China, Agricultural Bank of China, Industrial and Commercial Bank of China, China Construction Bank, China Merchants Bank, China Citic Bank, and other large banks are recommended.

You can delete the uploaded photos and upload again;

If the recognition error persists, you can call our customer service hotline (852) 2525 2437 or (86) 147 1501 7408.

Once the application is submitted, we will conduct a compliance review, which usually takes 1-2 working days. After the approval is completed, the customer will receive an account activation email from Victory Securities. Please ensure to fill in the correct email address and mobile phone number during application.

According to the SFC guidelines, online onboarding clients must complete the below transfer procedures as required to complete the account opening procedure.

- Please use the personal bank account registered in the account opening application to transfer the first deposit of no less than HK$10,000 or the same amount converted into other currencies to the bank account of the company "Victory Securities Co., Ltd.".

- After completing the transfer, please reply your transfer receipt (mark your name) to the email address provided by the company so that we can arrange payment verification;

- We will activate your stock account within 1-2 working days after receiving the relevant payment, and send the account password and account opening notification to your email address. You can log in to your stock account according to the relevant guidelines.

After we have accepted your account opening application and you have applied for E-trade and e-statement function, we will send the account opening information and login password to your registered email within 1-2 working days. Please use your account number and password to log in to the trading system or check the online statement.

Note: Please note that the English letters in the account number are not case sensitive, and the password must be a combination of 8 Roman numerals. In order to protect your account security, please do not share your online trading platform password to a third party.

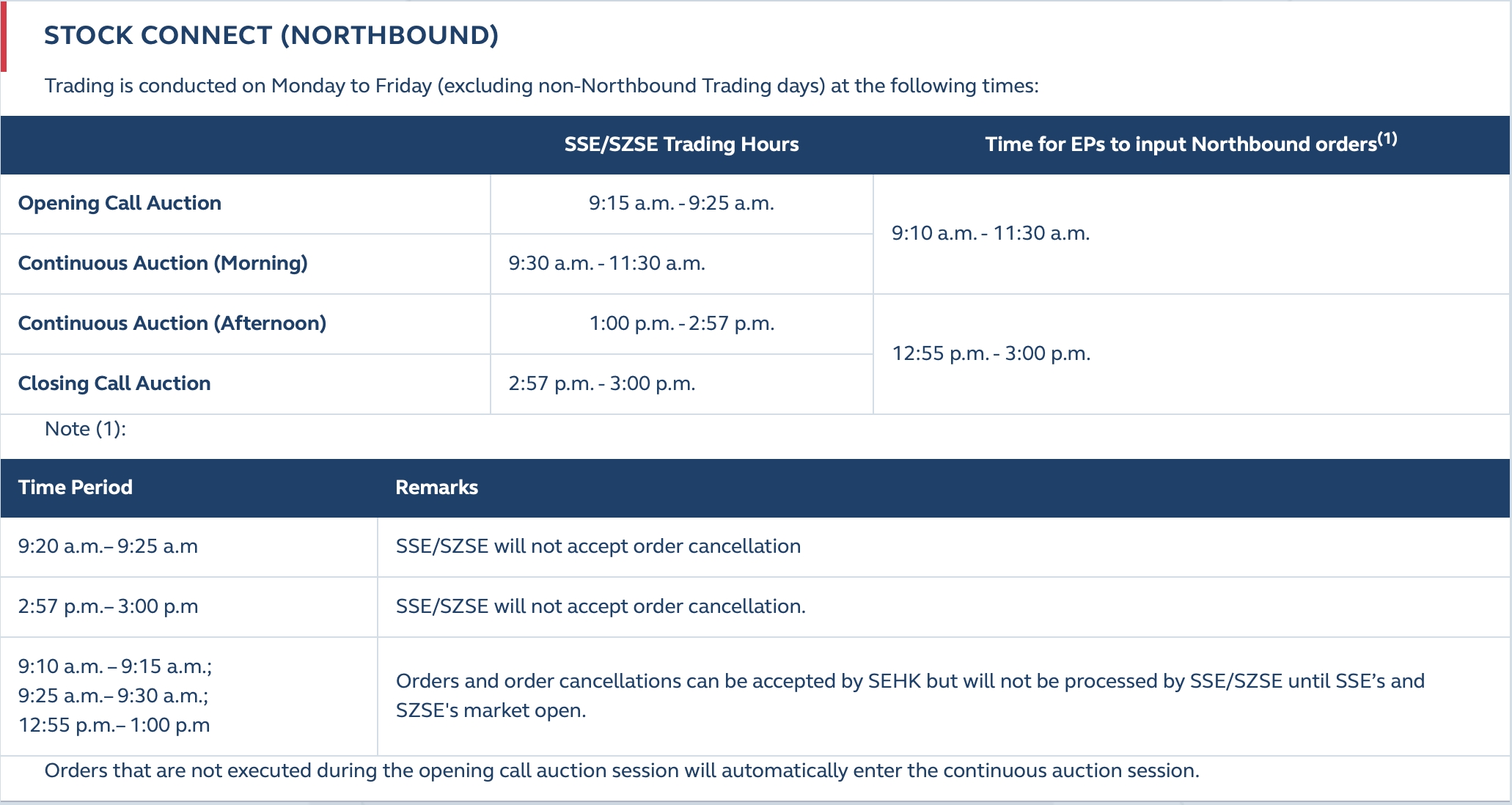

Trading is conducted on Monday to Friday (excluding public holidays) at the following times:

【Pre-opening】9:00-9:30

【Continuous Trading Session】9:30 - 12:00 and 13:00 - 16:00

【Closing Auction Session】16:00 - random closing between 16:08 and 16:10

Order types and price limit vary in different trading sessions. Please visit HKEX Website for details.

Except for public holidays and market closures due to inclement weather, the US stock market generally trades from Monday to Friday, and the trading hours are as follows:

The continuous trading session of US stocks is US Eastern Time (ET): Monday to Friday 9:30-16:00

US Summer Time (March to November): Hong Kong time 21:30-4:00

US Winter Time (November to March of the following year): Hong Kong time 22:30-5:00

US stocks are allowed to conduct pre-market and post-market trading outside the continuous trading hours, and pre-market and post-market orders will be submitted to the Exchange for order matching.

Nasdaq has a special pre-market and after-hours trading session, and each brokerage firm has different requirements for the pre-market and after-hours trading sessions. Victory Securities Trading Platform stipulates:

The market is closed on Saturdays, Sundays and public holidays.

Order types and price limit vary in different trading sessions. Please contact account manager for details.

In order to fully protect the interests of clients, clients and authorized persons are required to fill in relevant authorization documents. Clients can download the "Authorization Letter-Appointment of Authorized Person" and provide the authorized person's ID card and a copy of the address proof within 3 months, and sign it under the witness of the company's licensed person. After the application is approved, your authorized relatives and friends can issue transaction instructions on your behalf.

If you choose to authorize your account manager to execute orders on your behalf, your account will be defined as a "discretionary account". Please download the "Discretionary Account-Standing Authority" and sign the form under the witness of two licensed persons. And only after obtaining the approval of the company’s management, the account manager can issue trading instructions on your behalf.

There are many reasons that may lead to the failure of buy/sell orders. You can see the main reason in the status of the order. Your order may not be accepted under the following circumstances:

(1) There is not enough purchasing power in your account; or

(2) You have issued multiple buy orders, but the orders still have not been executed. These buy orders will withhold the purchasing power in your account. You may consider cancelling these buy orders before issuing a new order again.

Hong Kong market: Including equity securities, debt securities, unit trusts, exchange-traded funds and warrants listed on the Hong Kong Stock Exchange, as well as related derivative investment products such as futures indexes, bonds, and high-yield notes.

Other market: Victory Securities provides US stocks, Shanghai, Shenzhen A, B shares and other local securities markets (Including: Singapore, the United Kingdom, Europe, Southeast Asia, etc.) agency trading services.

If you are unable to modify or cancel the order via computer or communication equipment, please contact your account manager immediately or call our order hotline +852 2525 2437, +86 147 1501 7408 to contact client service, we are happy to help

*No additional charge for the service under this circumstance.

2FA (2-way factor authentication) refers to verifying the identity of a user through two factors of private information, personal belongings and physiological characteristics. It is an effective authentication mechanism to prevent hacker attacks.

The Guidelines for Reducing and Mitigating Hacking Risks Associated with Internet Trading, issued by the SFC on October 27, 2017, stated that the two-factor authentication should be implemented for the login program of clients' Internet trading accounts, that is, , through the information already known by the client (such as login password) and tools owned by the client (such as mobile phones) to verify the identity of the client. Using 2FA is not easy to obtain and crack, which can effectively reduce the risk of hacker intrusion.

Clients must use a two-factor authentication mechanism when logging in to the Victory Online trading account to ensure that their personal information or password will not be stolen. When logging in, clients need to enter another set of two-factor authentication code in addition to their login name and password:

- When you log in, the system will instantly send a two-factor authentication code via SMS to the phone number you registered

- Obtain the two-factor authentication code by downloading and registering the two-factor authentication "VIC Token" mobile phone authentication software.

New accounts opened since 2019 use the "VIC Token" to receive two-factor authentication passwords by default in order to avoid regional and mobile phone restrictions and delays in receiving SMS.

If existing clients want to activate the "VIC Token", please contact our client service department at +852 2525 2437 or +86 147 1501 7408 for arrangement.

Android system version: 4.4 or above

iOS version: 9 or above

Set automatic date and time

Fingerprint unlock function system requirements: Android 6.0 or above

Clients can follow the below deposit guidelines and send the deposit receipt after transaction via “Victories Securities Professional Edition” mobile app, send to Whatsapp at +852 5498 9438 or email to setl@victorysec.com.hk for settlement procedures.

Clients can apply for and authorize the setting of the "Simple Direct Debit Authorization" (sDDA) function through the "Victory Securities Professional Edition" mobile application (APP) to directly transfer funds from the client-designated bank account to the Victory Securities account.

For details on applying for and setting up the "Simple Direct Debit Authorization" (sDDA) function, please refer to the user instructions.

- For the "FPS" electronic payment service, clients can register and activate the "FPS" service in their bank account, and add our company as the registered payee, using our “FPS” account number 121092845 or mobile number +852 5498 9438, for fund transfer.

- Use Internet Banking to directly transfer funds to the "current bank account" provided by "Victory Securities Co., Ltd.". Please keep the deposit receipt to notify "Victory" of the deposit.

- Deposit or transfer at a bank branch, or use an ATM to transfer to the "current bank account" provided by "Victory Securities Co., Ltd."

please keep the deposit receipt to notify "Victory" of the deposit. - Deposit the cheque to the "current bank account" provided by "Victory Securities Co., Ltd.". Since the deposit certificate cannot show the name or account number of the issuer, please copy or photograph the cheque to protect both parties to protect both parties. Please keep the deposit receipt to notify "Victory" of the deposit.

*In order to protect the interests of clients, we only accept cheque or bank account transfers with the same name from the account holder, and do not accept third-party deposits!

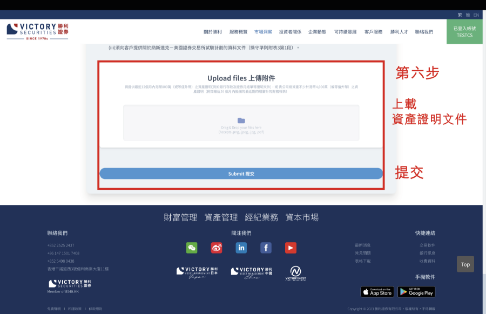

For online users, please use "Victory Securities Professional Edition" Mobile App to upload the deposit certificate.

Clients may also send the deposit certificate to the company′s settlement department at WhatsApp +852 5498 9438 with your registered phone number or email to setl@victorysec.com.hk for relevant settlement procedures.

* If you submit the deposit certificate by other phone numbers or methods (email, fax, post), please sign a valid signature (namely the signature specimen on the contract) on the deposit certificate before submitting.

We will need to check the account after receiving your transfer certificate. The cut-off time on working days is 4:45 pm. Transfer certificate submitted after this time will be processed on the second working day.

Clients can also log in to the "E-Statement Inquiry" section of the company's website to view the statement of the day and check the account status.

Clients can choose the settlement method when opening an account. Victory Securities provides two settlement methods

- Auto Settlement: After each transaction, it will be automatically settled in the trading account, and the deposit will be deposited in our trust account opened by Victory for the clients in a licensed bank in Hong Kong

- Bank Autopay: After each transaction, it will be automatically transferred to the bank account registered by the client

The following is the company's cut-off time. If clients have special withdrawal arrangements, please make fund withdrawal notice as soon as possible.

- Applications submitted before 12:00 noon will be processed on the same day.

- Applications submitted after 12:00 noon will be arranged for processing on the next working day.

Cheque

Clients need to notify their account manager or submit the "Fund Withdrawal" instruction through the online trading platform before 12:00 noon of the day. The instruction will be processed on the same day, and the client can use the money on the next working day.

CHATS/ Overseas TT remittance

1. Starting from January 2, 2025, HKD: Daily first withdrawal HKD$150, and subsequent withdrawals HKD$300 each;

USD: Daily first withdrawal USD$20, and subsequent withdrawals USD$40 each;

RMB: Daily first withdrawal RMB$150, and subsequent withdrawals RMB$300 each.

2. If clients need to make special withdrawals to other bank accounts other than those already registered, clients can download and fill in the "Withdrawal Instructions" application form on the company's website.

Cash cheque withdrawal

If the clients request to withdraw the balance in the account by cash check under certain circumstances, the maximum withdrawal limit is HK$50,000, and the clients must bring his/her identity document and come to the company in person for application.

If clients need to withdraw funds to an unregistered Hong Kong bank account, clients can download and fill in the "Withdrawal Instructions" application form on the company website or fill in the "Change of Account Information Form" to update your personal information to add new bank information.

If the clients do not have a Hong Kong bank account, the clients can download the “Withdrawal Instructions” form from the company’s website and return the filled-out form to apply for fund withdrawal. Withdrawal instructions will be processed as soon as possible according to client requirements.

HK Stock / A share

Corporation: Victory Securities Company LimitedBusiness Address: Room 1101-3, 11/F., Yardley Commercial Building, 3 Connaught Road West, Sheung Wan, Hong Kong

CCASS Number: B01445

Contact Person: Clearing Department Ms Choi/ Mr Liu

Contact Number: +852 2523 1726 / 2523 3133

Email: clearing@victorysec.com.hk

US Stock

Please contact your AE or CS team for inquiriesor email clearing@victorysec.com.hk for assistance

Clients can inquire about the methods for depositing or withdrawing physical stocks through the following channels:

Email: clearing@victorysec.com.hkWHATSAPP: (852) 5498-9438

Office Hour (From 9:00 to 18:00) call +852 2523 1726 / 2523 3133

Fees for deposit or withdrawal of physical shares:

Withdrawal of physical share fee:HKD 5 per board lot

Additional handling fee of HKD 100

Deposit of physical share certificate:

Physical stock transfer stamp duty: HK$5 for each transfer letterWhen customers make their first deposit, a random minimum deposit amount will be generated. When the customer deposits this minimum amount, their deposit address will be added to the whitelist. After completing the whitelist process, customers can proceed with deposits and withdrawals.

Whitelist Address:Whitelist addresses are used to manage the list of deposit source addresses. According to regulatory policy requirements and for your asset security, wallet ownership verification is required before adding addresses to the whitelist. After verification, deposits from that address will be automatically credited to the relevant account.

Customers are required to transfer from personal wallets. If you transfer from a platform wallet, the transfer will fail.

Do not use personal wallets that have been verified on exchange platforms to initiate deposits, otherwise the deposit may fail.

- Below minimum deposit amount

- Not using the specified network chain for deposit

- Customer depositing from exchange wallet

- Personal wallet address not whitelisted (whitelist address verification not completed)

- Deposit failed exchange review

| Clients | Digital Currency (Symbol) | Minimum Deposit Amount (Units) |

|---|---|---|

| (All clients) | Bitcoin (BTC) | BTC 0.0002 |

| Ethereum (ETH) | ETH 0.001 | |

| Solana(SOL) | SOL 0.001 | |

| (Professional investors) | Tether (USDT) | USDT 10 |

| USDTTRC20(USDTTRC20) | USDTTRC20 10 | |

| USD Coin (USDC) | USDC 10 |

- Issues with recipient address format or network chain

- Currency balance in account is less than withdrawal amount, or there are outstanding debts in accounts under the same name

- Withdrawal amount is less than withdrawal fee

- Personal wallet address for withdrawal has not completed whitelist verification process

- For other withdrawal failure reasons, please contact customer service or your account manager

| Clients | Digital Currency (Symbol) | First Withdrawal Fee of the Day (Units) | 2nd withdrawal fees of the day (units) | Minimum Withdrawal (Unit) (Per Request) | Exchange Administrative Fee (Refund) | Refund Platform Fee |

|---|---|---|---|---|---|---|

| (All clients) | Bitcoin (BTC) | BTC 0.0002 | BTC 0.0004 | BTC 0.005 | BTC 0.0002 | USD 5 |

| Ethereum (ETH) | ETH 0.0018 | ETH 0.0036 | ETH 0.05 | ETH 0.0018 | USD 5 | |

| Solana(SOL) | SOL 0.02 | SOL 0.04 | SOL 0.05 | SOL 0.02 | USD 5 | |

| (Professional investors) | Tether (USDT) | USDT 6 | USDT 30 | USDT 25 | USDT 6 | USD 5 |

| USDTTRC20 (USDTTRC20) | USDT 6 | USDT 30 | USDT 25 | USDT 6 | USD 5 | |

| USD Coin (USDC) | USDC 6 | USDC 30 | USDC 25 | USDC 6 | USD 5 |

| Clients | Digital Currency (Symbol) | First Withdrawal Fee of the Day (Units) | 2nd withdrawal fees of the day (units) | Minimum Withdrawal (Unit) (Per Request) | Exchange Administrative Fee (Refund) | Refund Platform Fee |

|---|---|---|---|---|---|---|

| (All clients) | Ethereum (ETH) | ETH 0.0018 | ETH 0.0036 | ETH 0.01 | / | USD 5 |

| Bitcoin (BTC) | BTC 0.0002 | BTC 0.0004 | BTC 0.001 | / | USD 5 |

H-shares, traded on Hong Kong's exchanges, are regulated by Chinese law and are freely tradable by anyone. These shares trade in Hong Kong dollar (HKD).

A-shares represent shares of publicly listed Chinese companies that trade on Chinese stock exchanges such as the Shenzhen and Shanghai Stock Exchanges. These stocks trade in yuan renminbi (CNY).

Bull Market

When the stock market as a whole is in a prolonged period of increasing stock prices.

Bear Market

Bear Market is the trading talk for the stock market being in a downward trend, or a period of falling stock prices.

Opening Price

The opening price is the price at which a security first trades upon the opening of an exchange on a trading day. An opening price is identical to the previous day's closing price if there is no trading in the first 30 minutes.

Closing Price

The closing price is the raw price or cash value of the last transacted price in a security before the market officially closes for normal trading.

Highest Price

It refers to the highest price among the prices traded on that day. Sometimes the highest price is only one transaction, and sometimes more than one.

Lowest Price

It refers to the lowest price among the prices traded on that day. Sometimes the lowest price is only one transaction, and sometimes more than one.

Blue-Chip Stocks

Blue-chip companies are usually well-established. Blue-chip stocks differ from other stocks in how well-known the companies are and in their solid fundamentals.

Blue-chip stocks offer some advantages over other assets. For example, blue-chip stocks tend to be more stable than other stocks, and they tend to provide earnings and stock price stability because the companies have been around for a long time and have built a solid reputation.

Some investors may see blue-chip stocks as a sort of haven during economic downturns because they are steady and generate stable profits, even though they might decline due to the downturn.

Hot stocks

It refers to stocks with large trading volumes, strong liquidity, and significant stock price fluctuations.

Board lot size

A board lot is a standardized number of shares defined by a stock exchange as a trading unit. The size of a board lot will vary. A stock exchange might define one board lot as equalling 1,000 shares for stocks priced under $1, and 100 shares for shares valued at more than $1. The thinking is that standardization increases liquidity, thus lowering spreads and making the market more efficient for everybody.

Fill Order

A fill is an executed order. It is the action of completing or satisfying an order for the stock. Generally, it can be measured by two indicators: the number of shares traded and the transaction value.

A tick

A tick is a measure of the minimum upward or downward movement in the price of a stock. A tick can also refer to the change in the price of a stock from one trade to the next trade.

Suspension of trading

A stock can be suspended from the Exchanges due to non-compliance with regulations. Once suspended, the stock is no longer traded on the Exchanges. Suspension of a company from trading, by the exchange, might be for several reasons but if the suspended company complies with all regulations, the suspension will be revoked and the shares will start trading again.

Advances and declines

Advances and declines refer generally to the number of stocks (or other assets in a particular market) that closed at a higher and those that closed at a lower price than the previous day, respectively.

Limit up / Limit down

There is a maximum increase (decrease) of the stock price in one day, which the SFC stipulates a previous day's closing price percentage. The stock price cannot exceed this limit; otherwise, trading will be automatically stopped.

Open High

It means that the opening price is much higher than the closing price of the previous day.

Open Low

It means that the opening price is much lower than the closing price of the previous day.

Sideways market

A sideways market refers to when asset prices fluctuate within a tight range for an extended period of time without trending one way or the other.

Distribution area

Distribution area occurs when stock is being sold by insiders and other knowledgeable investors in anticipation of a major price decline. A distribution area is generally characterized by relatively small price movements and heavy volume.

Gaps

Gaps occur because of underlying fundamental or technical factors. For example, if a company's earnings are much higher than expected, the company's stock may gap up the next day. This means the stock price opened higher than it closed the day before, thereby leaving a gap.

Price-to-Earnings (P/E) Ratio

The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS). The price-to-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

P/E ratios are used by investors and analysts to determine the relative value of a company's shares in an apples-to-apples comparison. It can also be used to compare a company against its own historical record or to compare aggregate markets against one another or over time.

It is generally believed that it is normal to keep the ratio between 20 and 30. If it is too small, it means that the stock price is low, the risk is small, and it is worth buying; However, stocks with high price-earnings ratios are mostly popular stocks, and stocks with low price-earnings ratios may be unpopular stocks.

Dip

Dip is that the new lower price represents a bargain as the "dip" is only a short-term blip and the asset, with time, is likely to bounce back and increase in value.

Rally

A rally usually involves rapid or substantial upside moves over a relatively short period of time.

Long position

Long position describes what an investor has purchased when they buy a security or derivative with the expectation that it will rise in value.

Short Position

Short position, is created when a trader sells a security first with the intention of repurchasing it or covering it later at a lower price.

Bull Market

A bull market is the condition of a financial market in which prices are rising or are expected to rise.

Bear market

A bear market is when a market experiences prolonged price declines.

Long to Short

The trader changes from a long position to a short position, and sometimes they will do the short selling.

Short to Long

The trader changes from short to long positions and repurchases the stock. Sometimes they will purchase more than they sell.

Long Selling

The trader expects that the stock price will rise, so purchase the stock, and the purchased stock is sold before the actual delivery. This is a speculative act to earn the difference between buying and selling.

Short Selling

In short selling, a position is opened by borrowing shares of a stock or other asset that the investor believes will decrease in value. The investor then sells these borrowed shares to buyers willing to pay the market price. Before the borrowed shares must be returned, the trader is betting that the price will continue to decline and they can purchase them at a lower cost. The risk of loss on a short sale is theoretically unlimited since the price of any asset can climb to infinity.

Bearish

Being bearish means that an investor feels that investment positions, or the market in general, will decline.

Bullish

A bullish stock is one that investors believe is going to go up in value or outperform its benchmark.

Stuck

Stuck means that the stock price declines after buying the stock or increases after selling the stock, which is out of traders' expectation.

Largest Stockholder

Largest Stockholder means, at the applicable time, the stockholder of the Company that is then the stockholder holding the largest number of the Company’s then outstanding Common Stock.

Large Shareholder

Refers to investors with larger investment.

Retail investor

A retail investor is a nonprofessional investor who buys and sells securities, mutual funds or ETFs through a brokerage firm or savings account.

Broker

A broker is an individual or firm that acts as an intermediary between an investor and a securities exchange. A broker can also refer to the role of a firm when it acts as an agent for a customer and charges the customer a commission for its services.

Short Swing Trading

Swing trading is a style of trading that attempts to capture short- to medium-term gains in a stock (or any financial instrument) over a period of a few days to several weeks.

Correction

In investing, a correction is a decline of 10% or more in the price of a security from its most recent peak. Corrections can happen to individual assets, like an individual stock or bond, or to an index measuring a group of assets.

An asset, index, or market may fall into a correction either briefly or for sustained periods—days, weeks, months, or even longer. However, the average market correction is short-lived and lasts anywhere between three and four months.

Investors, traders, and analysts use charting methods to predict and track corrections. Many factors can trigger a correction. From a large-scale macroeconomic shift to problems in a single company's management plan, the reasons behind a correction are as varied as the stocks, indexes, or markets they affect.

Stock lift

Stock lift is a standard method to raise the stock price by a large margin. Usually, prominent players will sell the stock after the stock is lifted to make huge profits.

Market manipulation

Market manipulation is the act of artificially inflating or deflating the price of a security or otherwise influencing the behaviour of the market for personal gain.

Black horse stock

In the past, the main performance of the general, suddenly in a certain period of time its stock price doubled or even multiple stocks.

White horse stock

The prince charming in fairy tales, which is sought after everywhere, and is the star of attention in the stock market.

Fakeout

A fakeout can cause considerable losses for a technical analyst. These investors will typically rely on well tested patterns, multiple affirmations of an indicator and specific allowances to protect from significant losses. Sometimes the setup can look perfect, but outside factors can cause a signal to not develop as planned.

Technical analysis

Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activities, such as price movement and volume.

Fundamental Analysis

Fundamental analysis (FA) is a method of measuring a security's intrinsic value by examining related economic and financial factors. Fundamental analysts study anything that can affect the security's value, from macroeconomic factors such as the state of the economy and industry conditions to microeconomic factors like the effectiveness of the company's management.

Unissued Stock

Unissued stock are company shares that do not circulate, nor have they been put up for sale to either employees or the general public. As such, companies do not print stock certificates for unissued shares. Unissued shares are normally held in a company's treasury. Their number typically has no bearing on shareholders.

Letter of Authorization

Written proof for shareholders that entrust others (other shareholders) to exercise their voting rights at the general meeting of shareholders.

Free Float Percentage

The free float percentage, also known as float percentage of total shares outstanding, simply shows the percentage of shares outstanding that trade freely.

Option

The term option refers to a financial instrument that is based on the value of underlying securities such as stocks. An options contract offers the buyer the opportunity to buy or sell—depending on the type of contract they hold—the underlying asset.

Ex-Right

The term ex-rights refers to shares of stock that are trading but no longer have rights attached to them. Rights, in this context, refer to the opportunity to purchase more shares of a new issue or offering at a given price.

Dividend

A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Common shareholders of dividend-paying companies are typically eligible as long as they own the stock before the ex-dividend date.

Cum rights

Cum rights (or "with rights") allow a shareholder of record to subscribe to a rights offering declared by a company. Owners of shares that have cum rights are able to buy new shares in a secondary offering, typically at a price lower than the current market price of the shares in question. This additional benefit gives such shares of stock an additional theoretical value.

Capital Increase

Capital Increase means an increase in the capital stock of the Borrower, which capital stock shall be issued by the Borrower in connection with the Preemptive Rights Offering, the Tender Offer and the Merger.

Rights Issue

A rights issue is an invitation to existing shareholders to purchase additional new shares in the company. This type of issue gives existing shareholders securities called rights. With the rights, the shareholder can purchase new shares at a discount to the market price on a stated future date.

Front Running

The practice by market-makers of dealing on advance information provided by their brokers and investment analysts, before their clients have been given the information.

Speed resistance line

Speed resistance lines are a tool in technical analysis used for determining potential areas of support and resistance in the market.

Support line

Support, or a support level, refers to the price level that an asset does not fall below for period of time. An asset's support level is created by buyers entering the market whenever the asset dips to a lower price. In technical analysis, the simple support level can be charted by drawing a line along the lowest lows for the time period being considered. The support line can be flat or slanted up or down with the overall price trend. Other technical indicators and charting techniques can be used to identify more advanced versions of support.

Gaps

Gaps occur because of underlying fundamental or technical factors. For example, if a company's earnings are much higher than expected, the company's stock may gap up the next day. This means the stock price opened higher than it closed the day before, thereby leaving a gap.

Breakout

A breakout refers to when the price of an asset moves above a resistance area, or moves below a support area. Breakouts indicate the potential for the price to start trending in the breakout direction. For example, a breakout to the upside from a chart pattern could indicate the price will start trending higher. Breakouts that occur on high volume (relative to normal volume) show greater conviction which means the price is more likely to trend in that direction.

Buying

Buy is a term used to describe the purchase of the security that's typically paid for via an exchange of money.

Selling

The term sell refers to the process of liquidating the security in exchange for cash.

Unchanged

Unchanged refers to a situation in which the price or rate of a security is the same between two periods.

Trend

A trend is the overall direction of a market or an asset's price. In technical analysis, trends are identified by trendlines or price action that highlight when the price is making higher swing highs and higher swing lows for an uptrend, or lower swing lows and lower swing highs for a downtrend.

Full-Cash Delivery

Full-cash delivery is a settlement method when a futures or options contract expires or is exercised. Also known as cash settlement, it requires the seller of the financial instrument to transfer the associated monetary value of the asset to the buyer, rather than deliver the actual physical underlying asset.

Whipsaw

Whipsaw describes the movement of a security when, at a particular time, the security's price is moving in one direction but then quickly pivots to move in the opposite direction.

Reciprocal transfer

Reciprocal transfer means a transfer in which the entity receives assets or services or has liabilities extinguished and directly gives approximately equal value in exchange to the other party or parties to the transfer.

Clients can log in to the online trading platform one trade day before the IPO listing. The number of shares and funds will be allocated to the client's account during the day's trading session (before 3:30 PM).

If you have bounded your account with mobile, you will receive an SMS message notifying you of new share allocation result one trading day before the IPO listing. Or you can check with your delegated account manager anytime.

The handling fee is HK$50 per transaction for a cash subscription; the handling fee for a subscription with margin financing is HK$100 per transaction. The handling fee is non-refundable regardless of the subscription is successful or not.

Subscription funds are subject to the subscription price and quantity.

Clients can refer to the following calculation methods:

If the subscription is successful, a fee of 1.0077% will be charged. The fee includes 1.0% brokerage commission, 0.0027% SFC transaction levy, and 0.005% SEHK transaction fee.

Margin interest is calculated as follows:

Financing IPO Subscription Amount X Interest X Value Date

For more information, please refer to the IPO prospectus for details.

Cash subscription handling fee and the subscription fee will be deducted from the account on the IPO closing date.

The deposit for financing subscription will be deducted from the account on the day of the IPO deadline, and the handling fee and interest will be deducted on the refund date. After deducting the relevant fees, refunds for unsuccessful subscriptions will be made on the refund date.

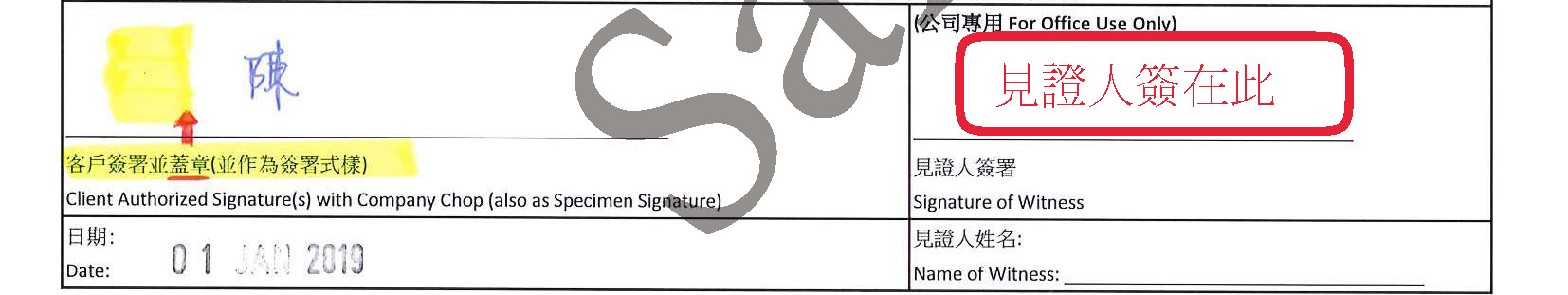

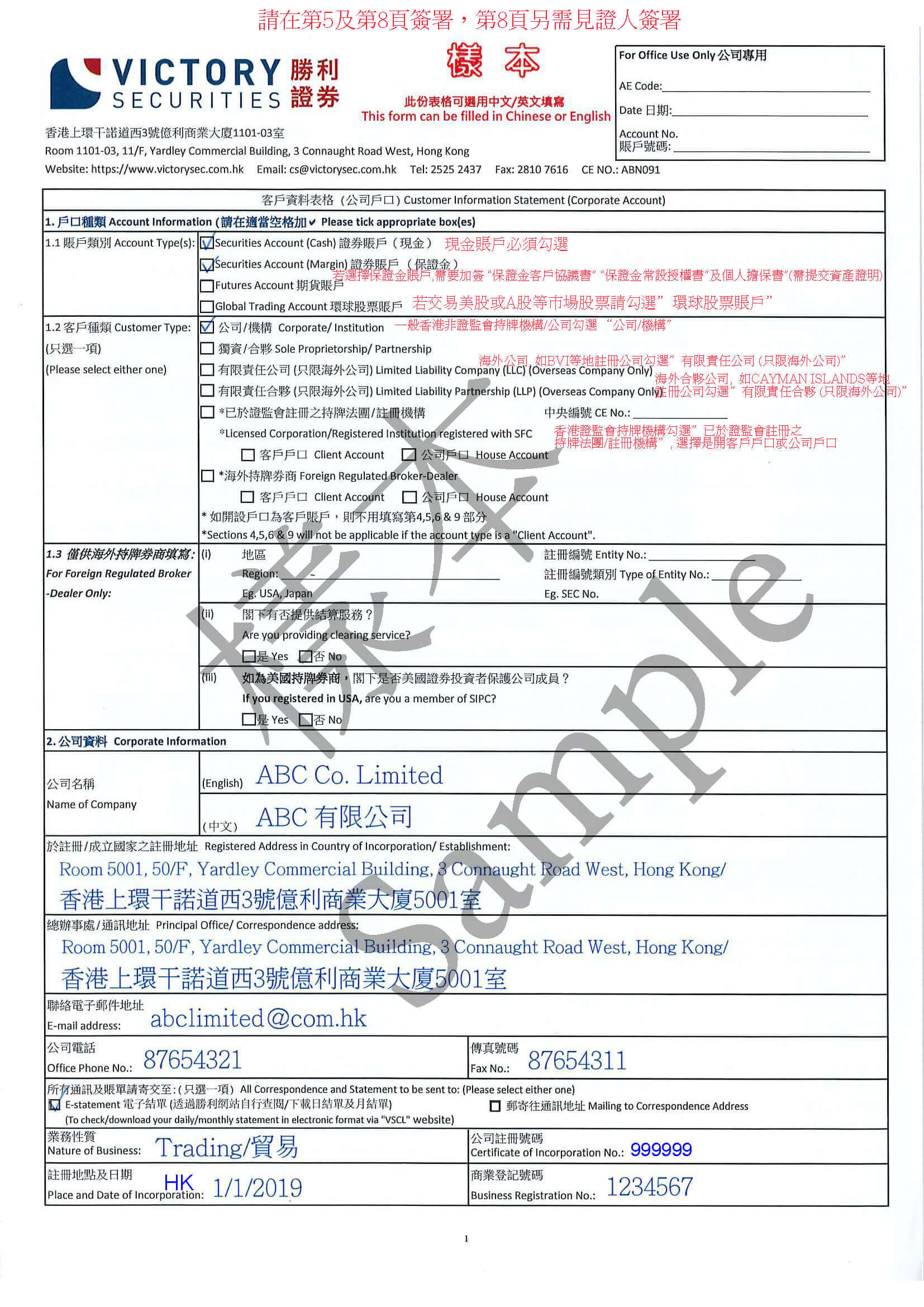

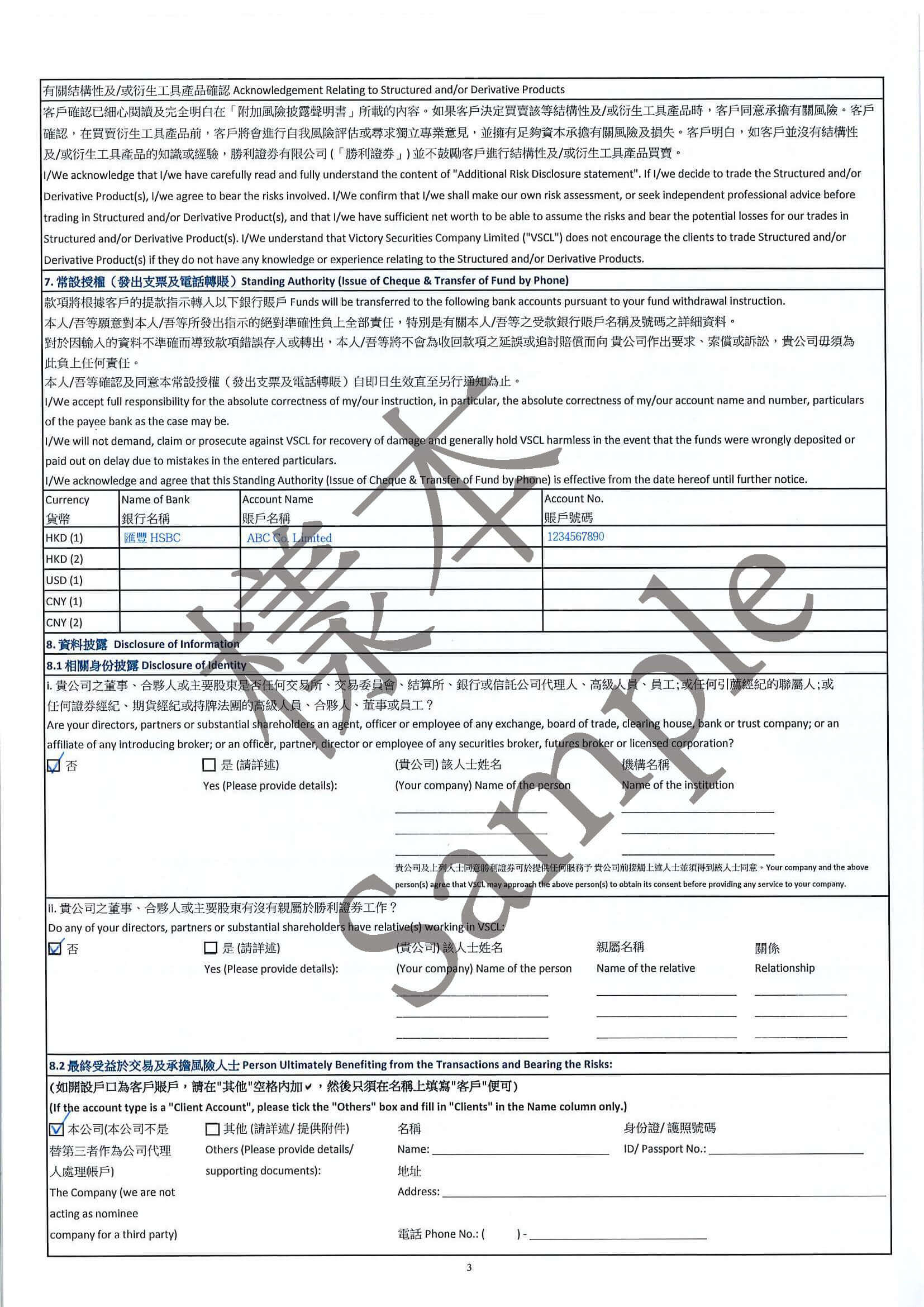

- By Mail: Once the account opening form and accompanying documents have been verified and signed in the presence of a witness (including page 8 of the Corporate Account Opening Form), you can mail them to Victory Securities’ Hong Kong office. Once all documents are in order, the review process should take around 2 to 3 days. The account will be opened upon approval.

- In Person: The corporate director or authorized signatory, as specified in the meeting minutes, must bring the original or certified copies of the required documents to Victory Securities' Hong Kong office. The forms must be filled out and signed in person. Once all documents are in order, the review process should take around 2 to 3 days. The account will be opened upon approval.

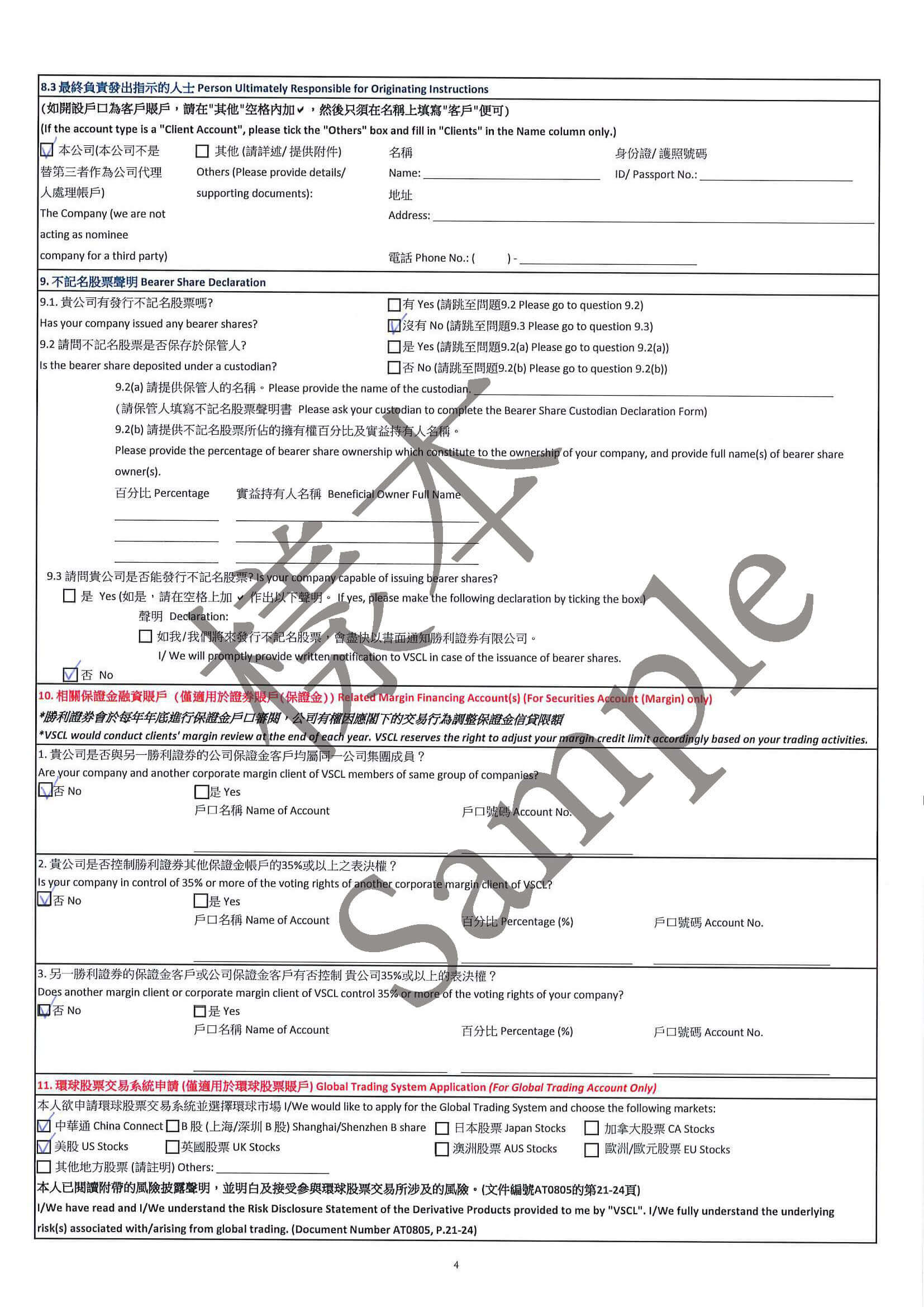

- Corporate Account Opening Form (Page 8 should be signed in the presence of a witness)

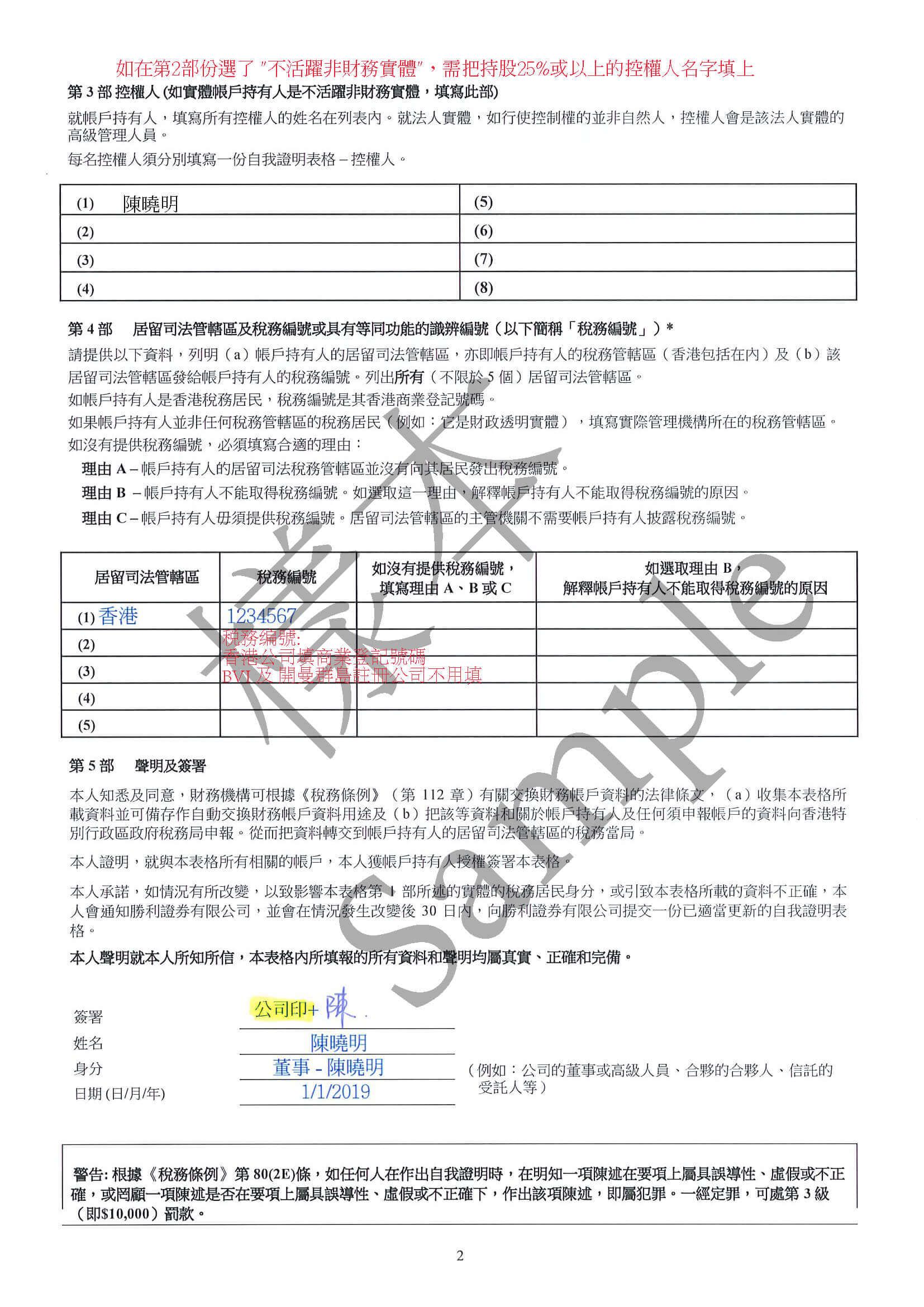

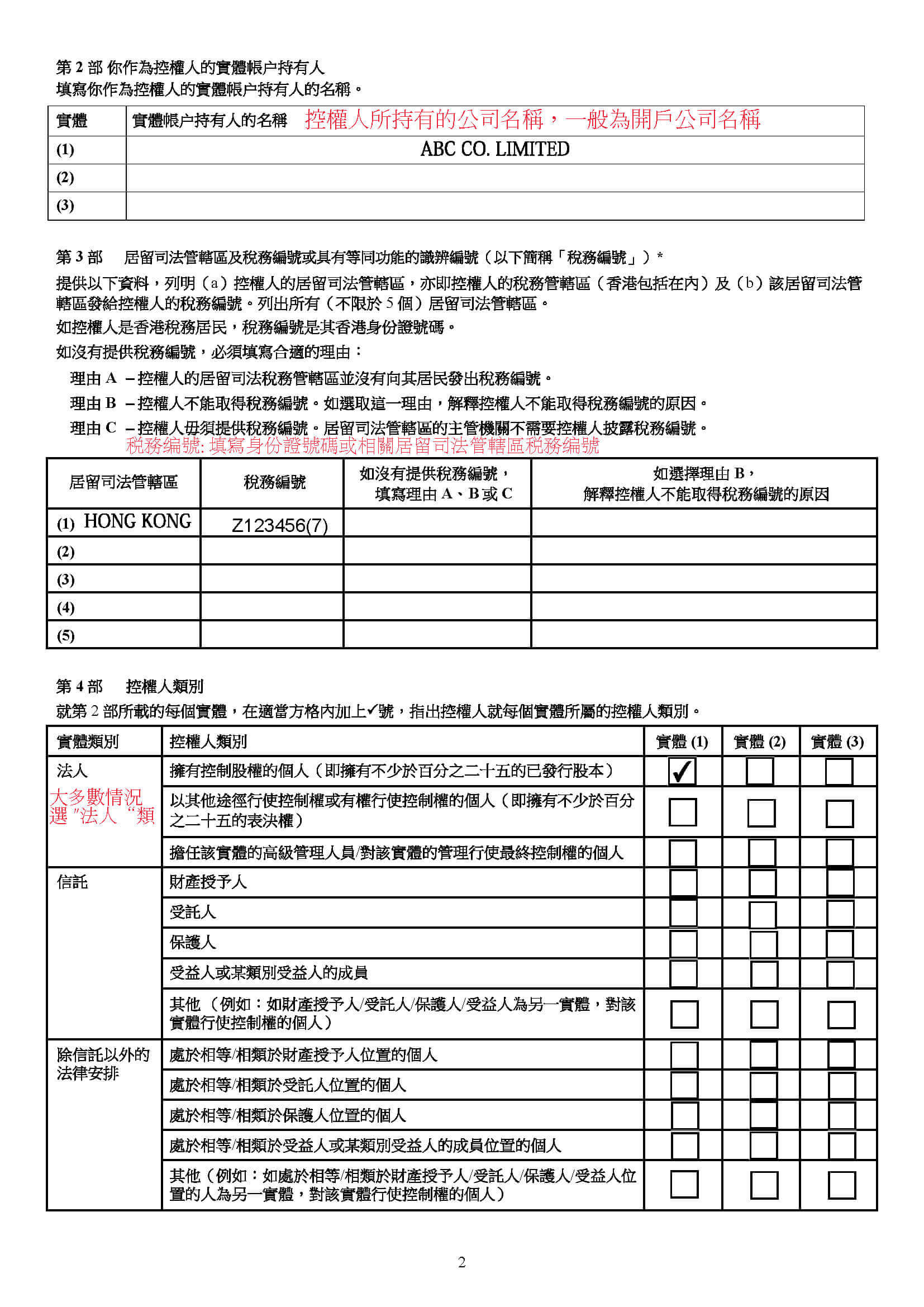

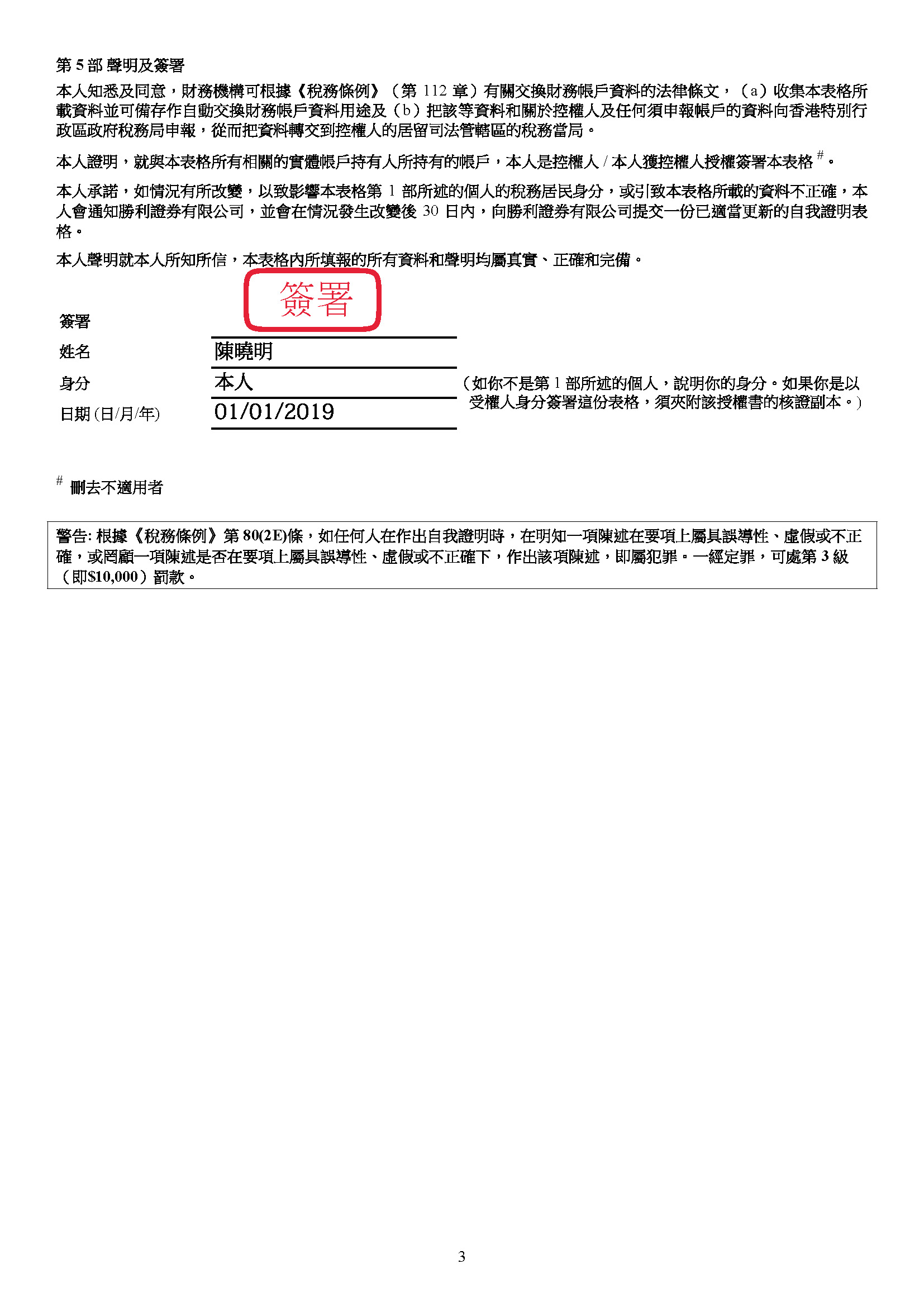

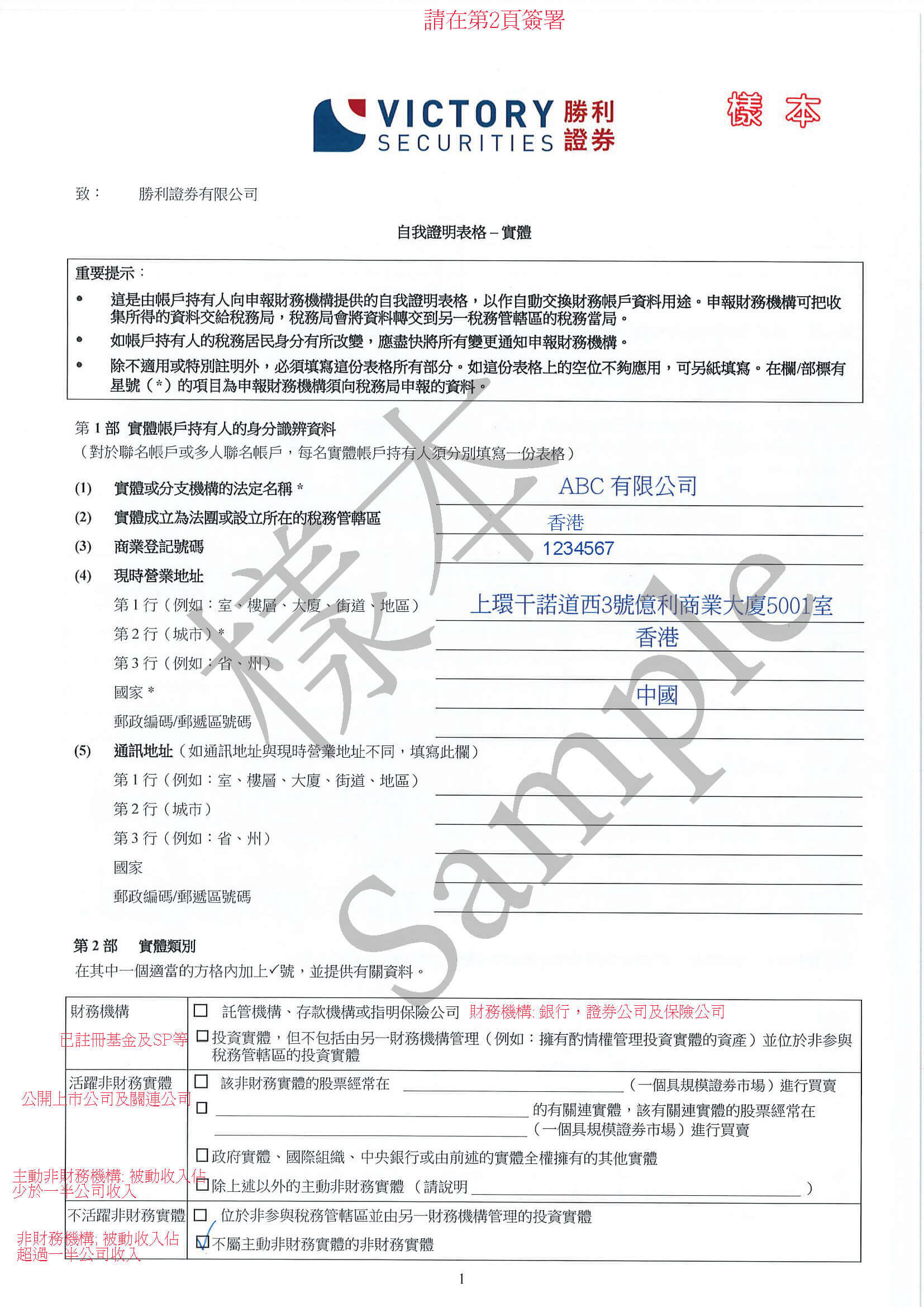

- Self-Certification Form for Entity (Applicable to all companies and entities)

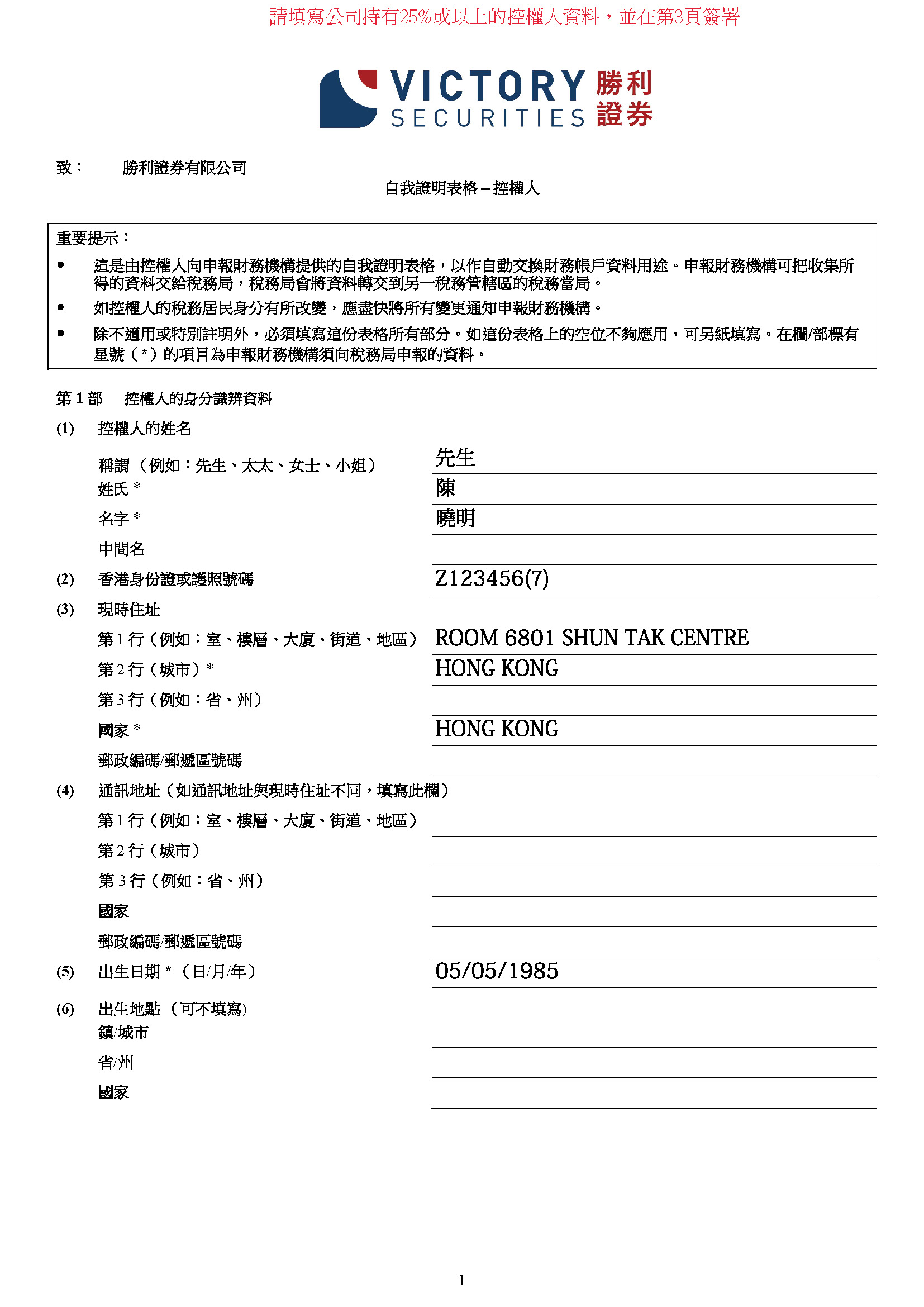

- Self-Certification Form for Controlling Person (Applicable to non-financial institutions and companies and entities with predominantly passive income)

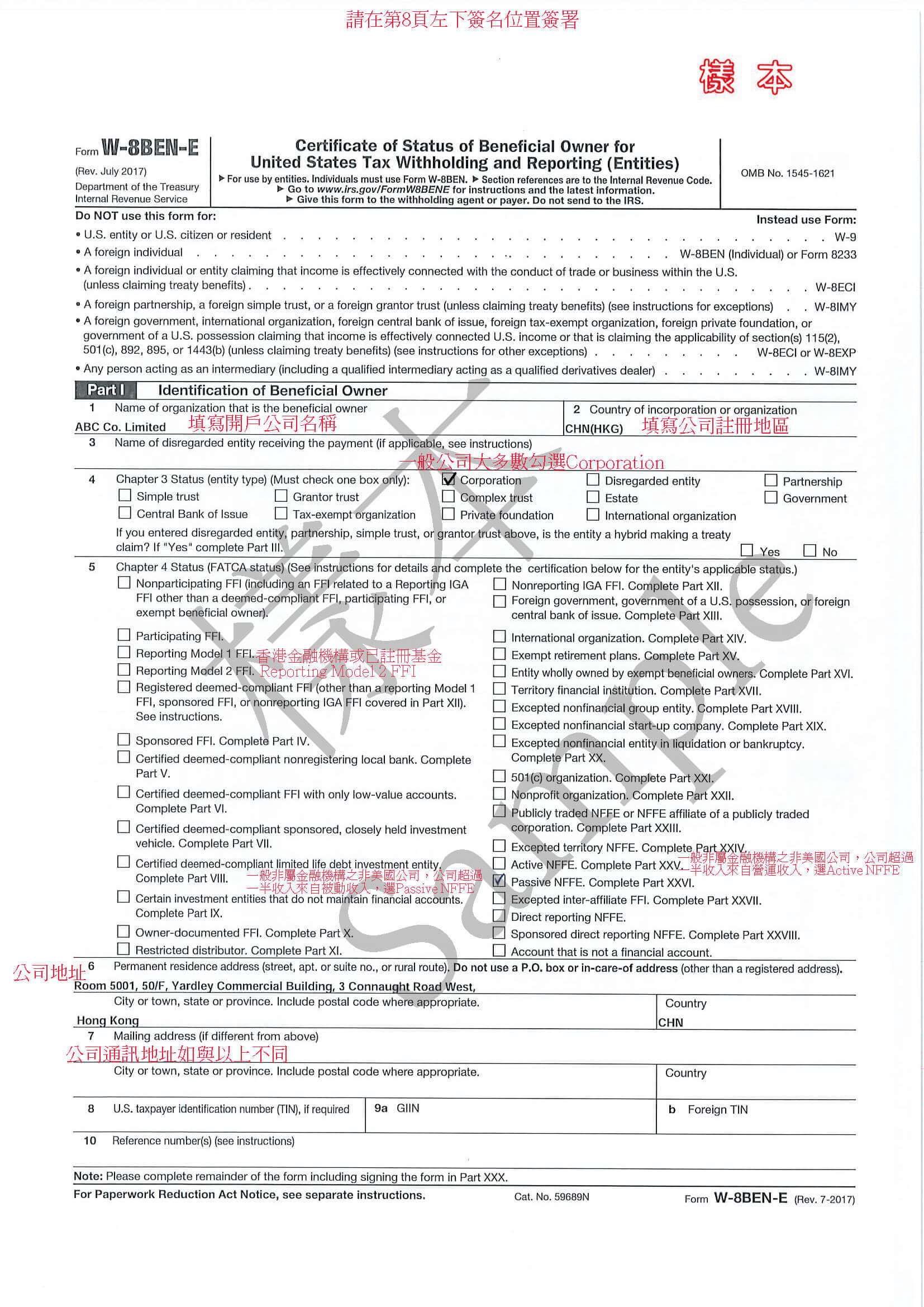

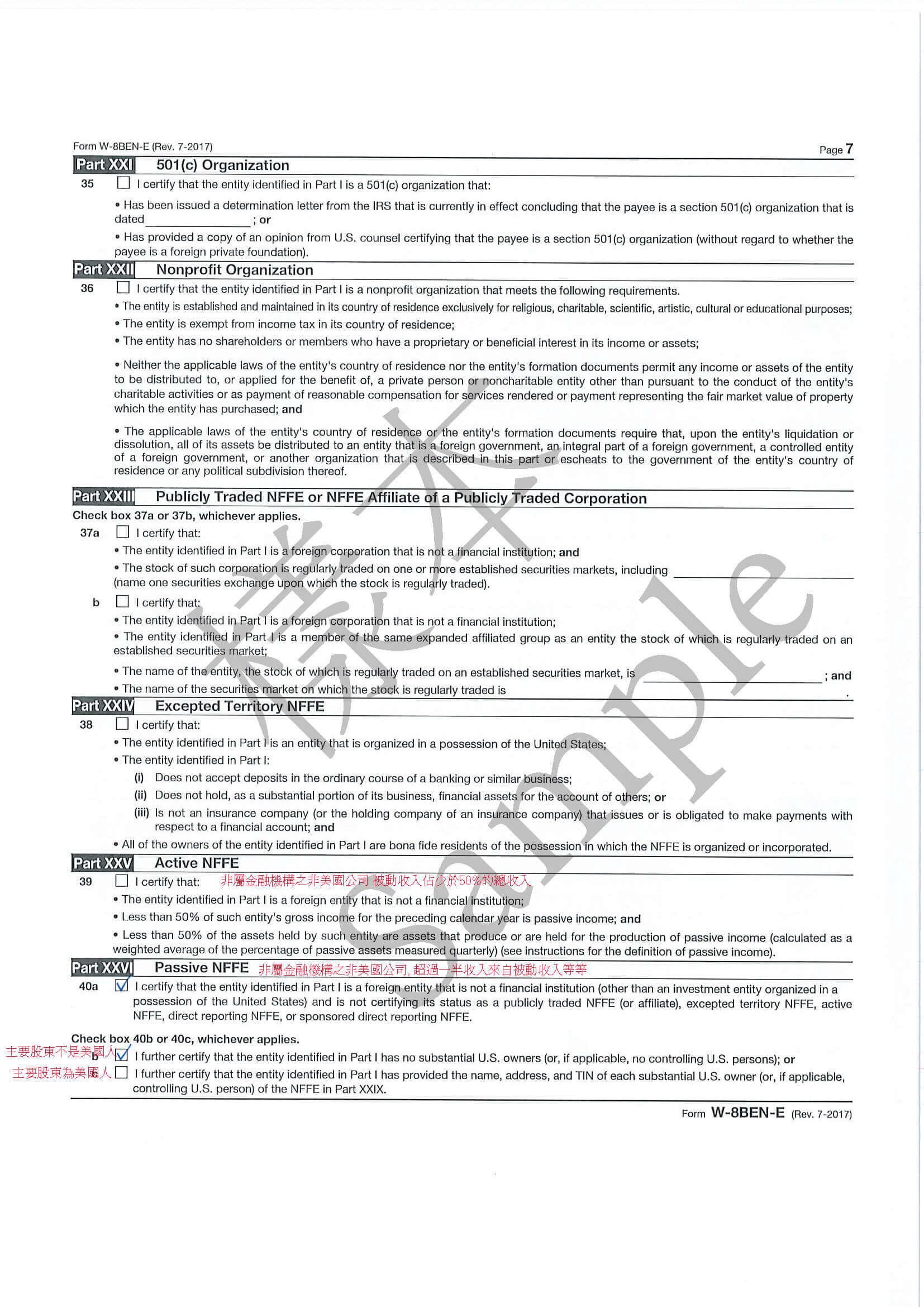

- W-8BEN-E Form

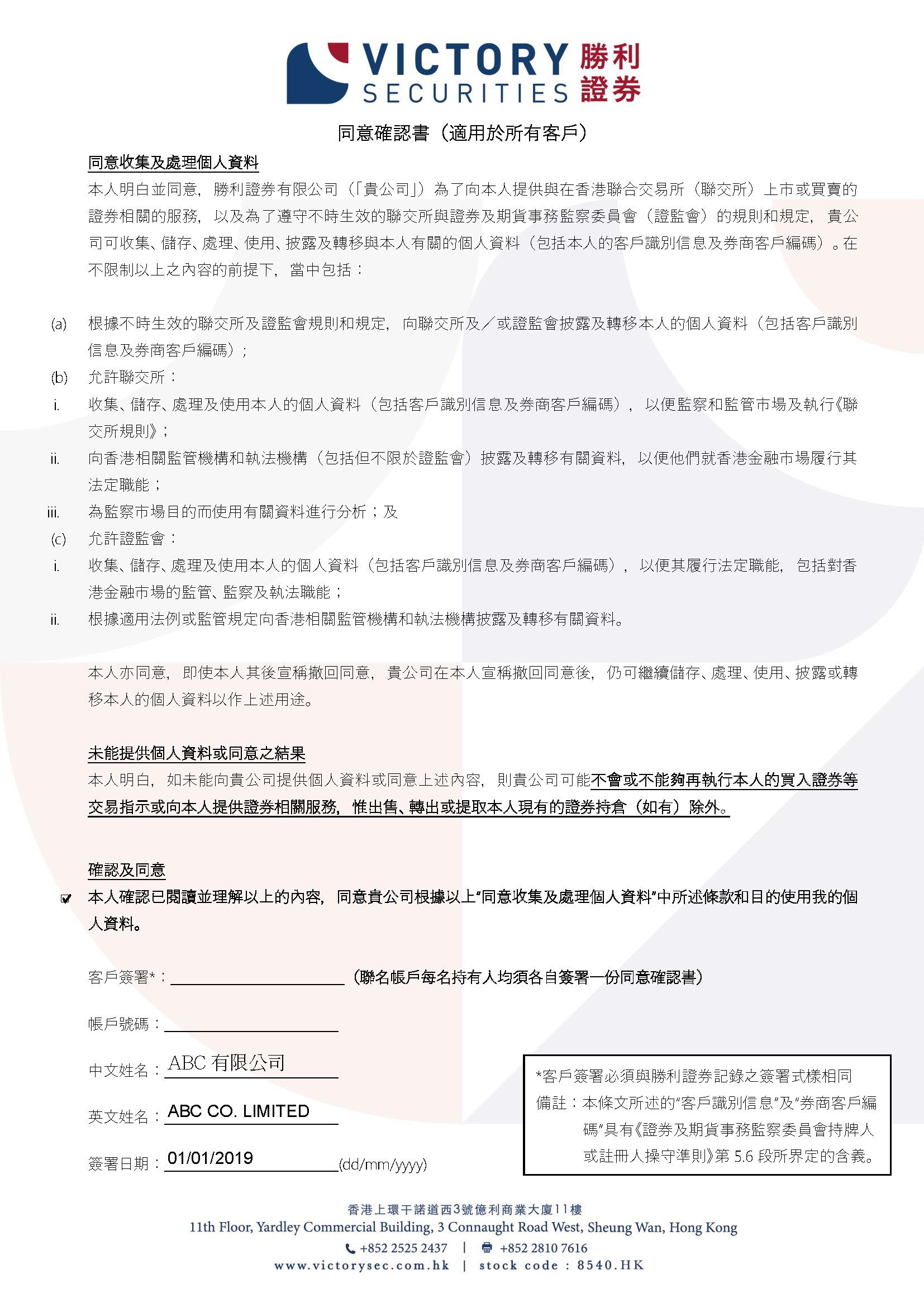

- Confirmation of Consent, Hong Kong Investor Identification Regime (HKIDR), and the Over-the-Counter Securities Transaction Reporting Regime (OTCR)

- China Connect Supplemental Terms and Conditions

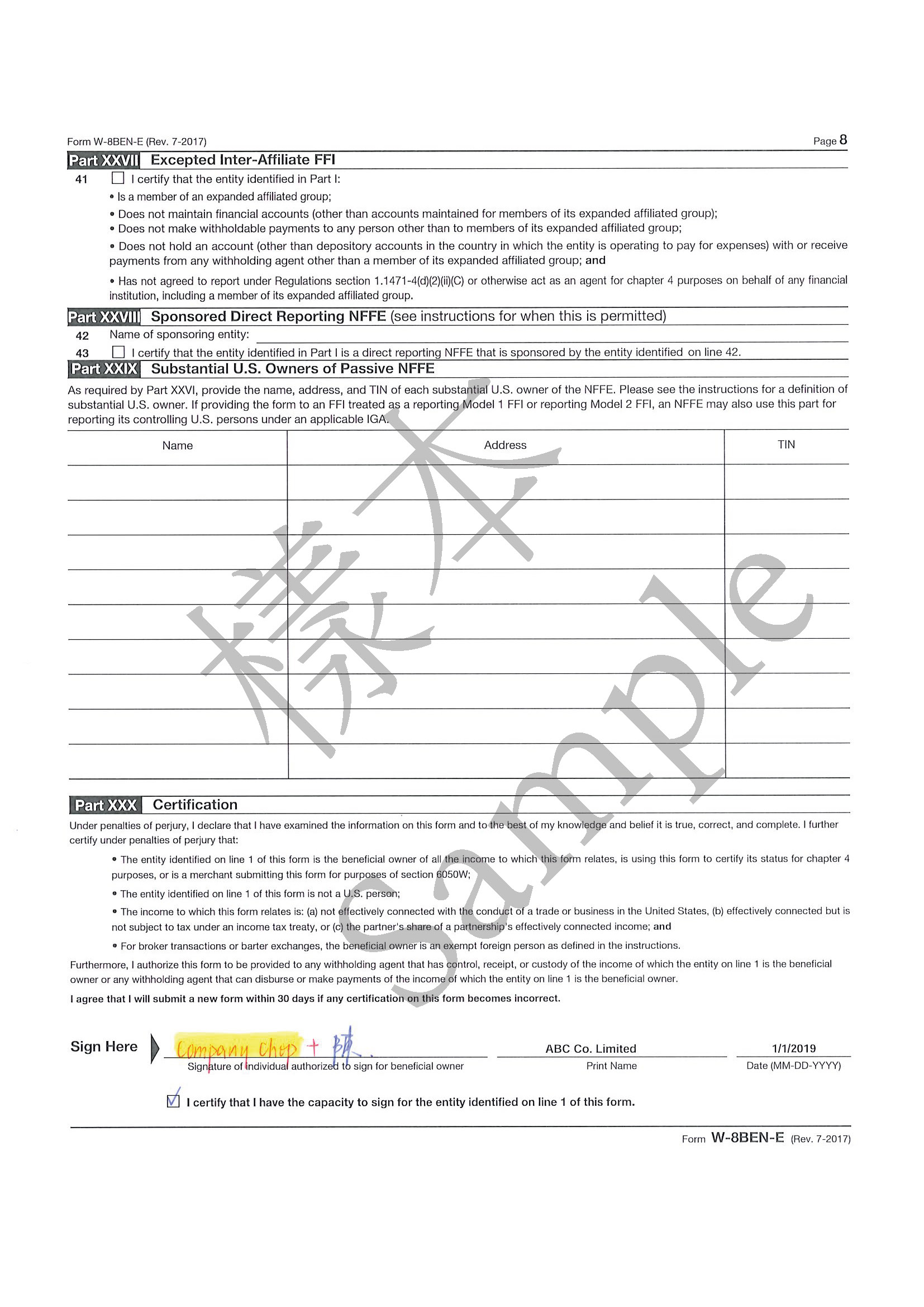

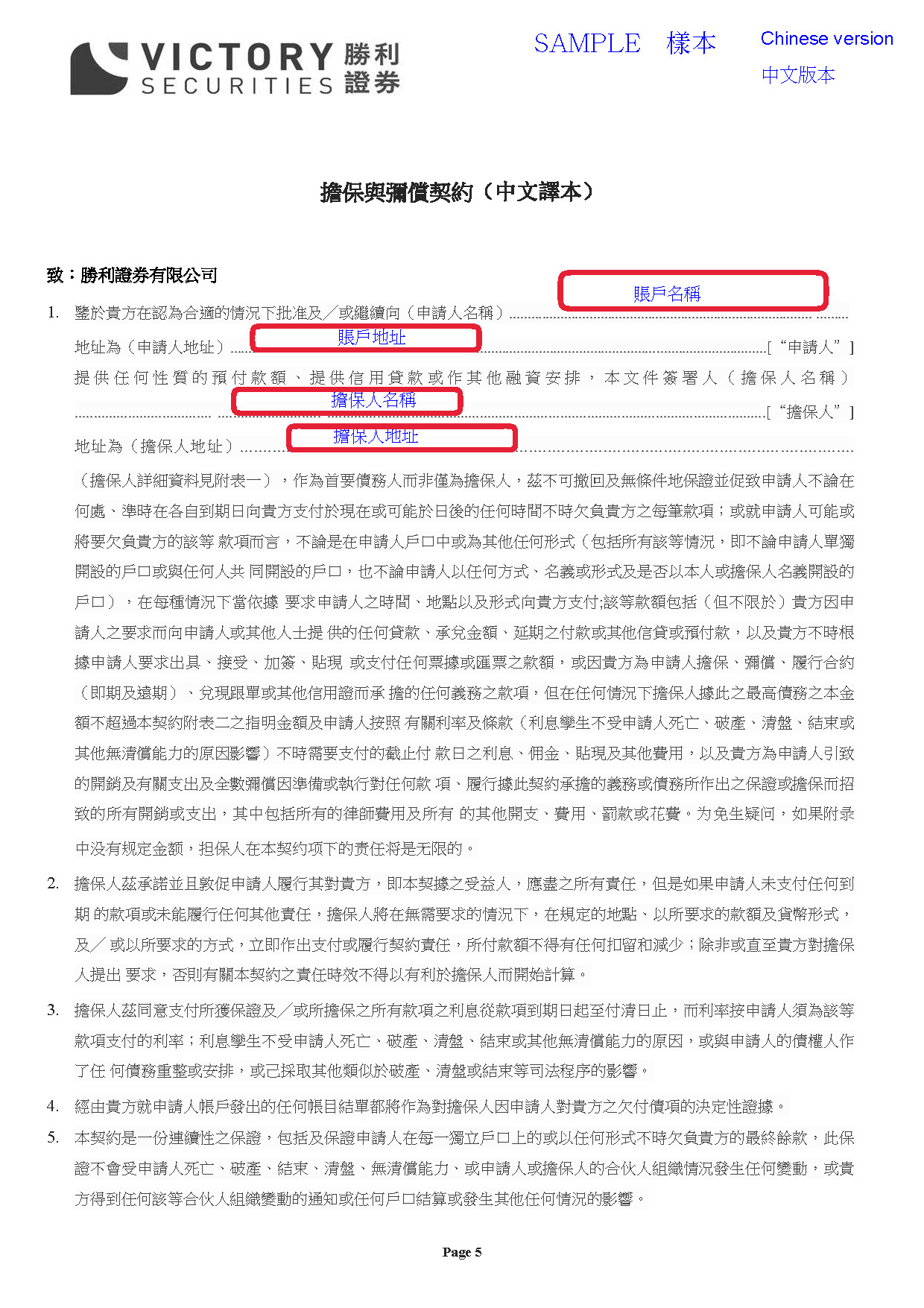

- Personal Guarantee Agreement (Page 8 should be signed in the presence of a witness)

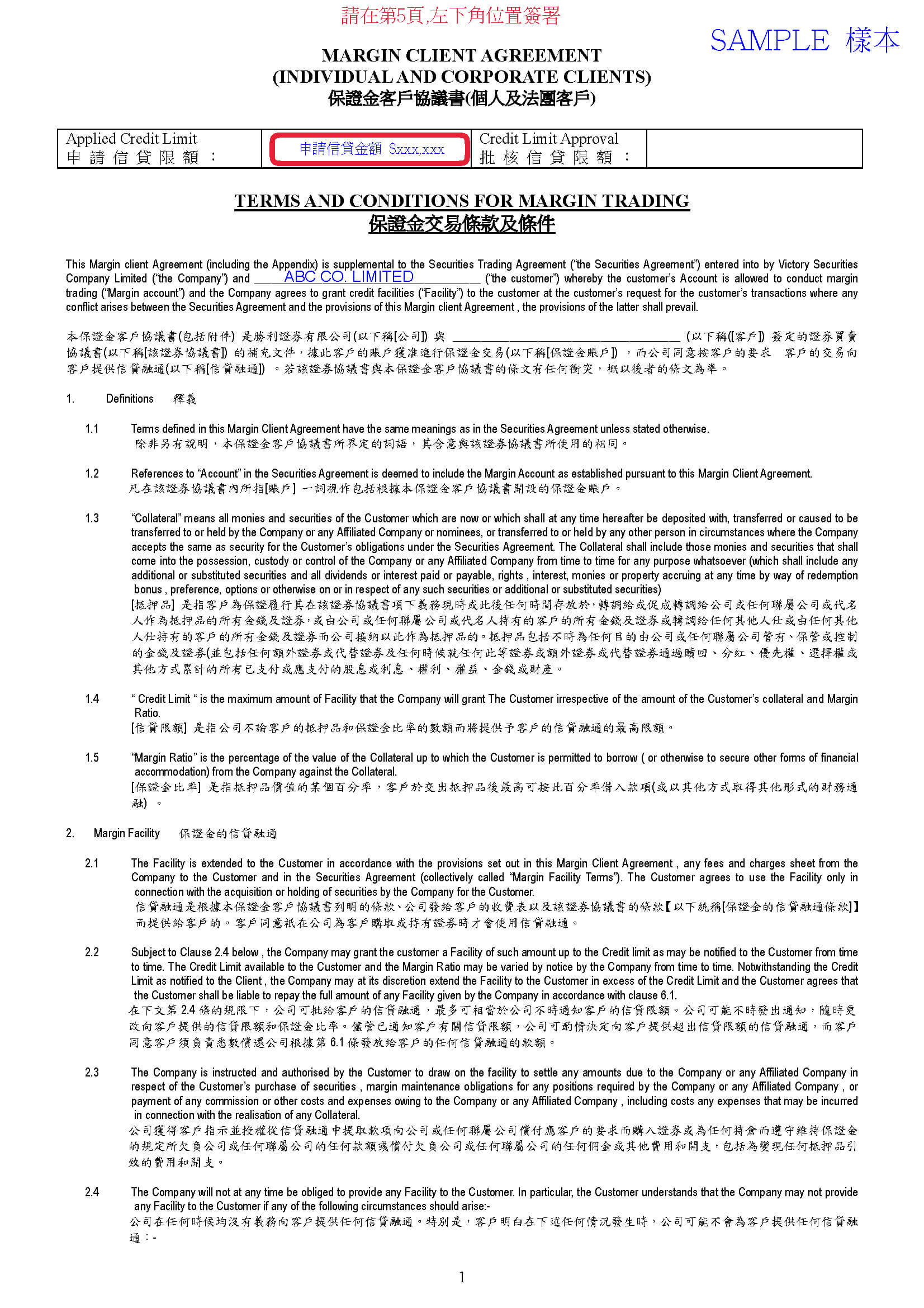

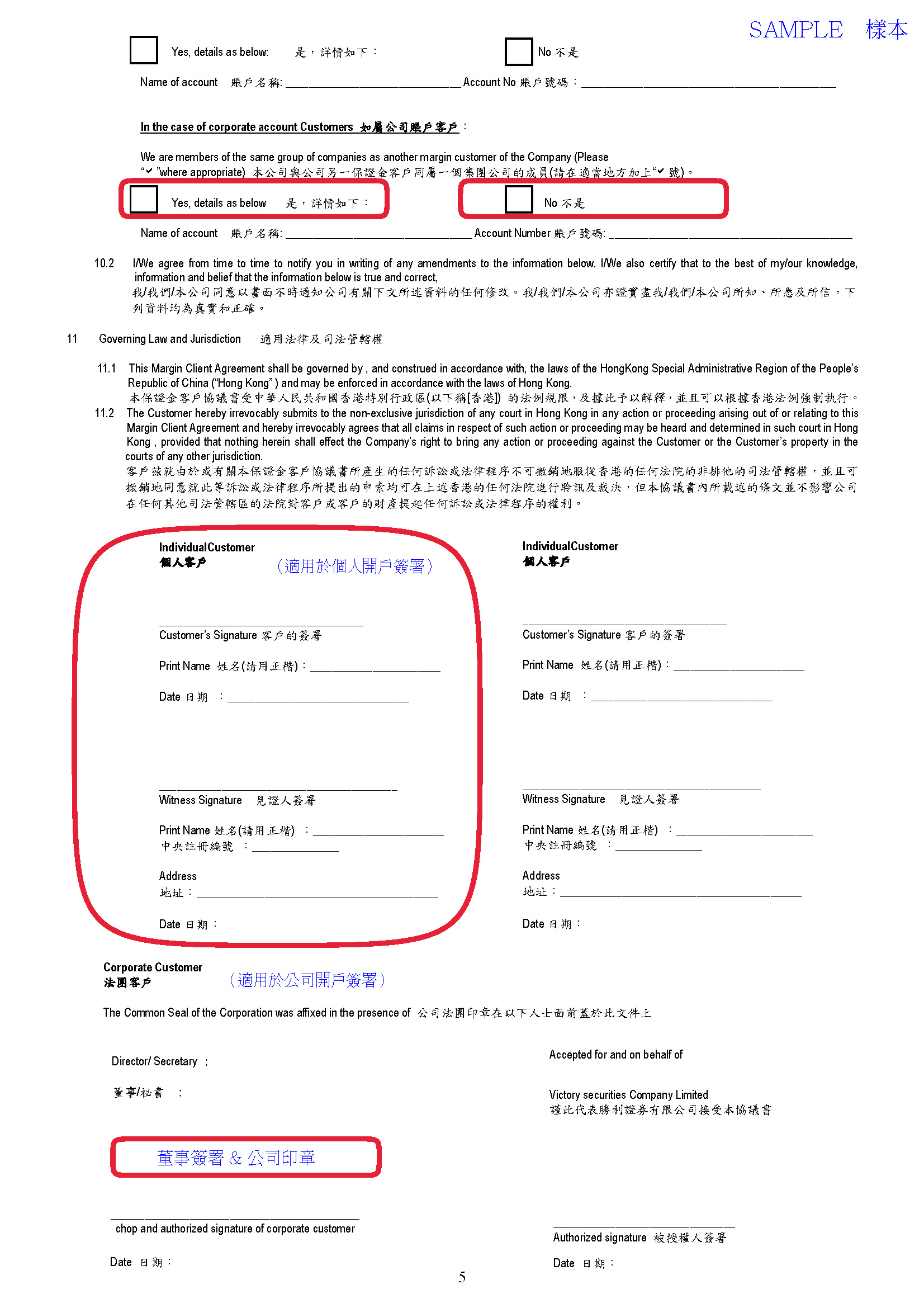

- Margin Client's Agreement

- Standing Letter of Authorization

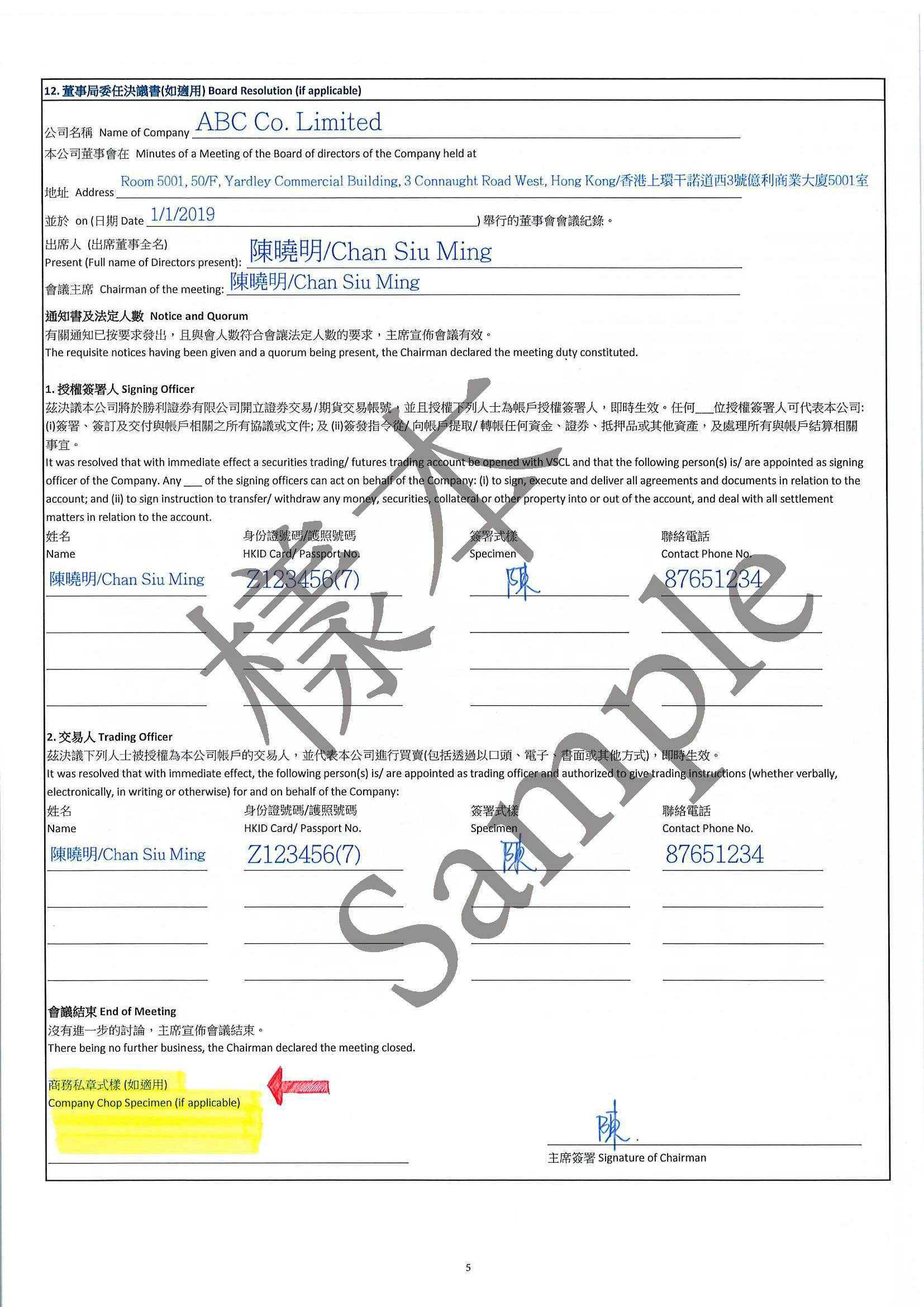

- A Copy of Board Resolution (can be completed on page 5 of Corporate Account Opening Form) Sample 1;

- A Copy of the following identification documents (both sides are required for Chinese Resident Identity Cards) /a copy of the passport (personal information page) and proof of address (within the last three months) Sample 2

- All company directors;

- Authorized trader (determined by the Board of Directors);

- Authorized signatory (determined by the Board of Directors);

- Ultimate beneficial owner (holding a minimum of 10% or more of the company's ultimate interests/shares);

- Certificate of Incorporation (CI) (Sample 3) and subsequent certificates of corporate name change (if applicable);

- Articles of Incorporation or Rules (Sample 4);

- Proof of Corporate Address (Sample 2);

- Corporate Bank Account (Sample 5);

- Latest Annual Return (Sample 6),all subsequent Notice of Change of Company Secretary/Director (Appointment/Cessation) (Form D2A/ND2A), Return of Allotment (Forms SC1 / NSC1), and/or share transfer documents detailing the information of current shareholders (if applicable);

- Valid Business Registration Certificate (BR) (Sample 7);

- Chart of Shareholding Structure (can be signed by company directors);

- By Mail: Once the account opening form and accompanying documents have been verified and signed in the presence of a witness (including page 8 of the Corporate Account Opening Form), you can mail them to Victory Securities’ Hong Kong office. Once all documents are in order, the review process should take around 2 to 3 days. The account will be opened upon approval.

- In Person: The corporate director or authorized signatory, as specified in the meeting minutes, must bring the original or certified copies of the required documents to Victory Securities' Hong Kong office. The forms must be filled out and signed in person. Once all documents are in order, the review process should take around 2 to 3 days. The account will be opened upon approval.

- Corporate Account Opening Form (Page 8 should be signed in the presence of a witness)

- Self-Certification Form for Entity (Applicable to all companies and entities)

- Self-Certification Form for Controlling Person (Applicable to non-financial institutions and companies and entities with predominantly passive income)

- W-8BEN-E Form

- Confirmation of Consent, Hong Kong Investor Identification Regime (HKIDR), and the Over-the-Counter Securities Transaction Reporting Regime (OTCR)

- China Connect Supplementary Terms and Conditions

- Personal Guarantee Agreement (Page 8 should be signed in the presence of a witness)

- Margin Client's Agreement

- Standing Letter of Authorization

- A Copy of Board Resolution (can be completed on page 5 of Corporate Account Opening Form)Sample 1;

- A Copy of the following identification documents (both sides are required for Chinese Resident Identity Cards) /a copy of the passport (personal information page) and proof of address (within the last three months) Sample 2

- All company directors;

- Authorized trader (determined by the Board of Directors);

- Authorized signatory (determined by the Board of Directors);

- Ultimate beneficial owner (holding a minimum of 10% or more of the company's ultimate interests/shares);

- Certificate of Incorporation (CI) (Sample 3) and subsequent certificates of corporate name change (if applicable);

- Articles of Incorporation or Rules (Sample 4);

- Proof of Corporate Address (Sample 2);

- Corporate Bank Account (Sample 5);

- Director Records (Available from local business service providers or intermediaries) (Sample 10);

- Shareholder Records (Available from local business service providers or intermediaries) (Sample 11);

- Director's Certificate of Incumbency (issued within the last six months) (available from local business service providers or intermediaries)(Sample 12);

- Chart of Shareholding Structure (can be signed by company directors);

- This must be selected for cash accounts.

- If opting for a margin account, you will also need to sign the Margin Client’s Agreement, Standing Letter of Authorization, and Personal Guarantee Agreement (asset proof required).

- If you will be trading U.S. stocks or A shares, please select “Global Stock Account”.

- Fill in the name of the company opening the account.

- Fill in the jurisdiction of company registration.

- Select“Corporation”for general companies.

- FATCA status

- Reporting Model 2 FFI (Select this option for Hong Kong Financial Institutions or Registered Funds)

- Active NFFE (Select this option for Non-U.S entity that is not a financial institution, and less than 50% of its gross income is passive income).

- Passive NFFE (Select this option for Non-U.S entity that is not a financial institution, and more than half of its gross income is passive income).

- Provide the company address.

- If the company’s mailing address differs from the above.

How to Open a Personal Account

How to Open a Corporate Account

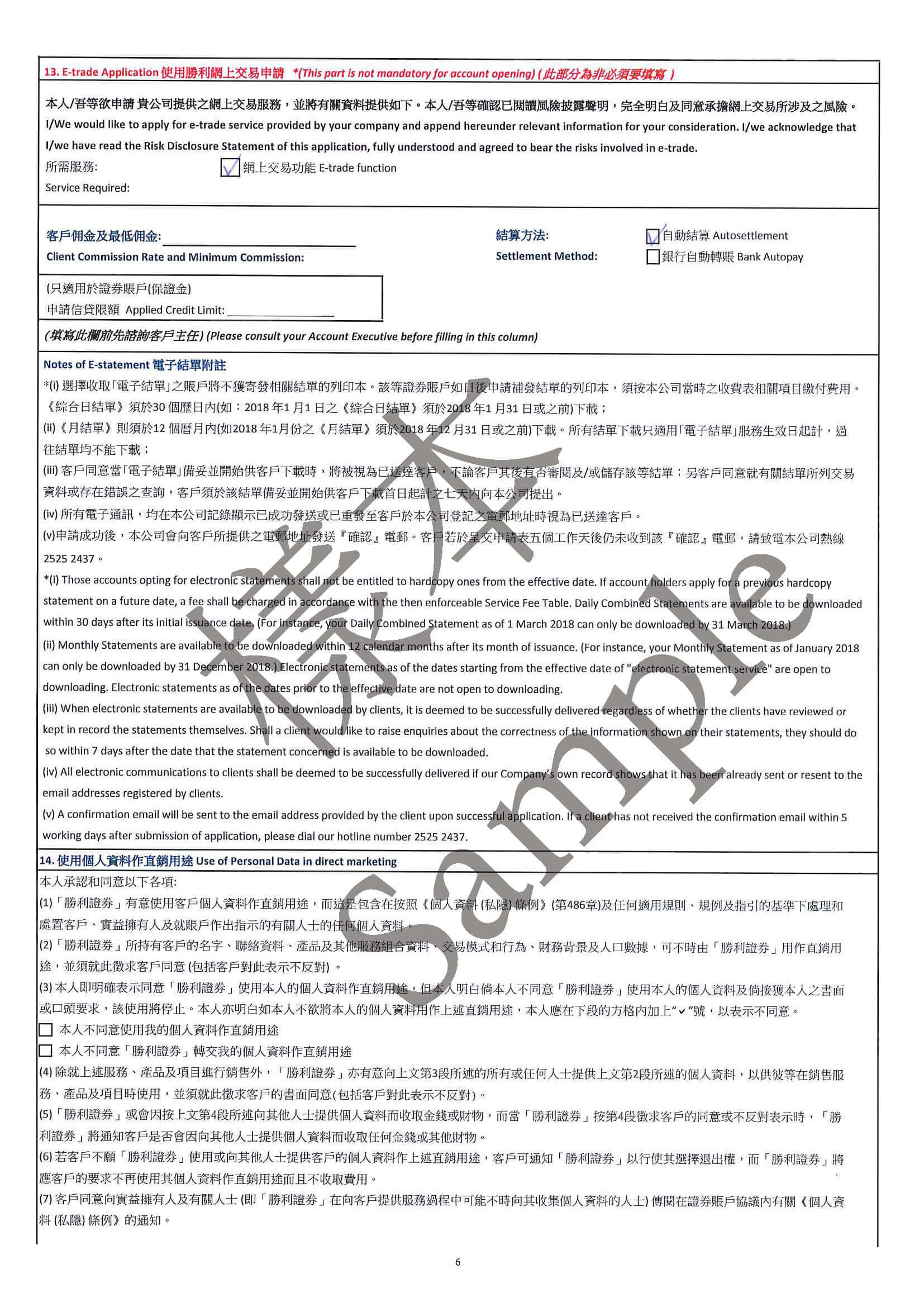

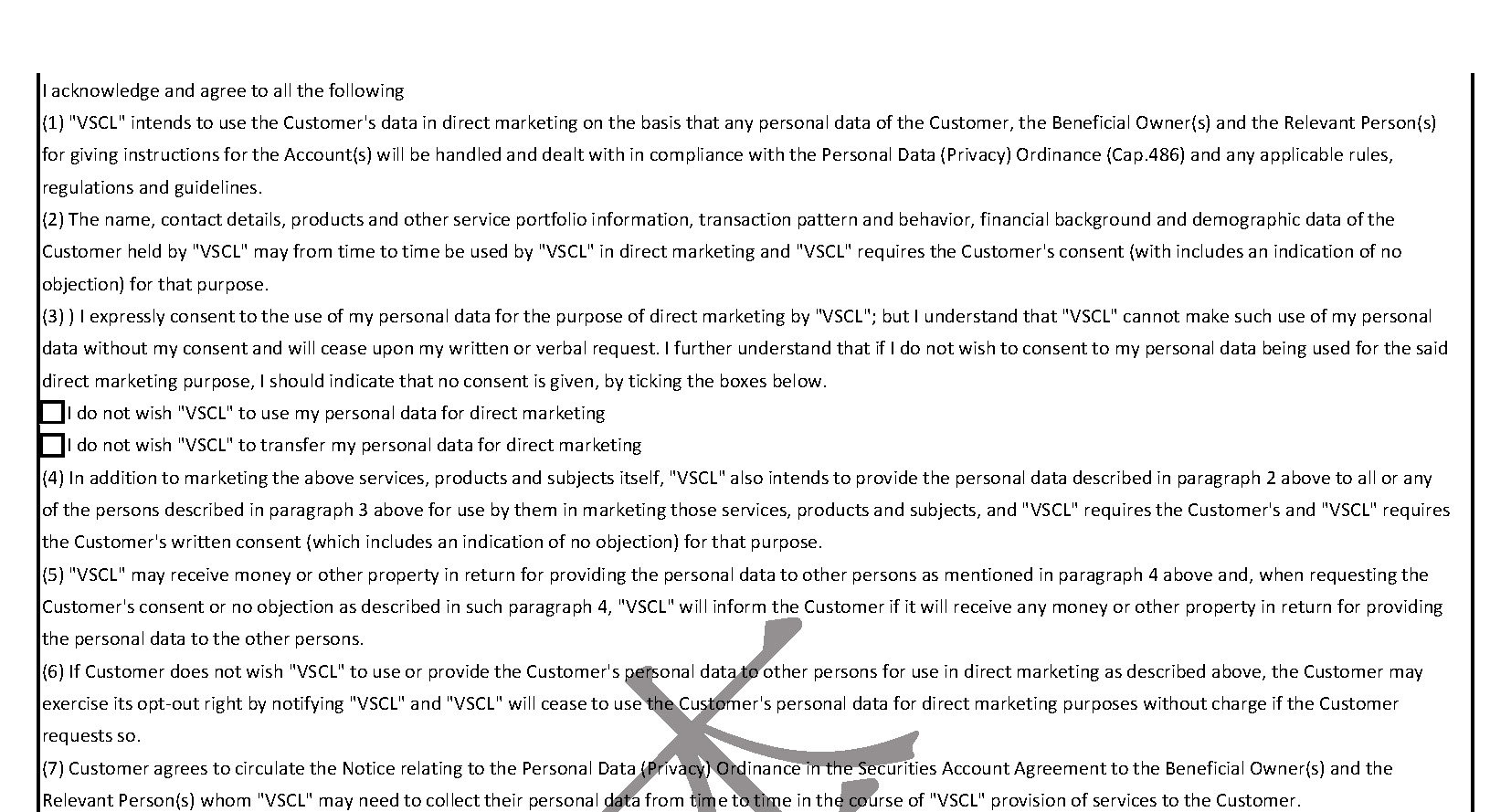

lient must be a non-resident of Mainland China. After completing the securities account opening, both new and existing clients are required to fill in and sign the following 4 documents, please refer to the following link for the electronic form of the relevant documents:

https://www.victorysec.com.hk/en/client/forms